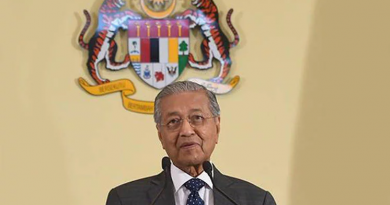

Global investors regain some confidence in Malaysia after GE14: S&P Ratings

KUALA LUMPUR: Global investors have regained some confidence in Malaysia and its currency after the surprise victory of the Pakatan Harapan in the GE14 in May 2018, says S&P Global Ratings.

In its report issued on Tuesday, it said nearly one in five (20.5%) polled intend to increase their exposure to the ringgit, up considerably from six months ago.

S&P said this was based on a survey in a report published titled, “Fixed-income investors cite trade disputes and Brexit as growing concerns.”

The ratings agency said despite concerns about growth targets, China’s large and growing fixed-income market remains a top destination for global investors.

“None of those polled plan to decrease their exposure to China or the other two top Asia destinations (India and Japan) over the next 12 months,” it said.

S&P said the poll showed fixed-income investors have become more attuned to risk over the course of 2018.

Geopolitical risks including trade disputes top concerns, according to this year’s second biannual poll of bond money managers by S&P Global Ratings.

“The Sino-U.S. trade dispute has become a top worry for fixed-asset investors, second only to European political risk, most of which is related to Brexit,” said Ritesh Maheshwari, S&P Global Ratings managing director and Asia-Pacific head of market outreach.

“Investors are also concerned about whether major economies such as China and the US will meet growth expectations,” he said.

The global survey of 176 institutional investors in fixed income, conducted in conjunction with HSBC, showed that about one in 10 investors cited a US slowdown as a risk.

This was in contrast with its other biannual five surveys over the past three years, in which the issue of a negative US economic surprise was not raised as an issue.

As to Asia in general: a strong 93.8% majority of those polled said they would increase exposure to regional credits over the coming year. This compares with 91.0% in the previous round in March this year, and 74.8% in its first poll in 2016.

These allocation decisions stand out, given that a strong dollar environment has increased volatility of emerging market currencies and other assets.

“Unlike like past episodes of emerging-market capital flight, sell-offs have been uneven, a sign that investors are discriminating based on economic fundamentals and policy frameworks,” said Maheshwari.

“Asian currencies and credit in particular have been spared, at least relative to the severe market fallout in Turkey and Argentina.”

Some 60% of respondents are based in Asia-Pacific, 21.6% in Canada or the US, and 18.2% in Europe or the UK. Collectively, they represent US$918bil in assets under management.

On infrastructure, green and environmental, social and governance (ESG) factors infrastructure and utilities (86.4%) remains the top sector driving Asian fixed-income performance.

Moreover, this preference is not losing steam. Of those polled, 88.1% said they will increase their exposure to the infrastructure sector, up 23 percentage points from the average over previous years.

Some 39% of investors polled are invested in green bonds. This compares with just 21.3% in our early-2018 survey, and 14.6% in its first survey in 2016.

“This surge comes as investors increasingly acquaint themselves with the green-bond parameters and risk-return dynamics. More than two-thirds of investors said they planned to increase exposure to green bonds.

“Our survey results on environmental, social and governance factors (ESG) offer another sign that money managers are increasingly interested in “sustainable investing.”

“More than 42% of investors already incorporate ESG factors into their decisions, a rapid acceleration from previous survey results. This is up from 29% in the first round,” S&P Global Ratings said.

Source: TheStar