Hibiscus to drill eight oil wells this year

KUALA LUMPUR: Hibiscus Petroleum will be drilling eight oil wells this year, six in Malaysia and two in the United Kingdom, which is set to increase its production volumes.

The eight wells are currently in the process of being sanctioned, and is expected to involve a capital expenditure in the region of US$75mil (RM304.55mil), spent equally between Malaysia and UK.

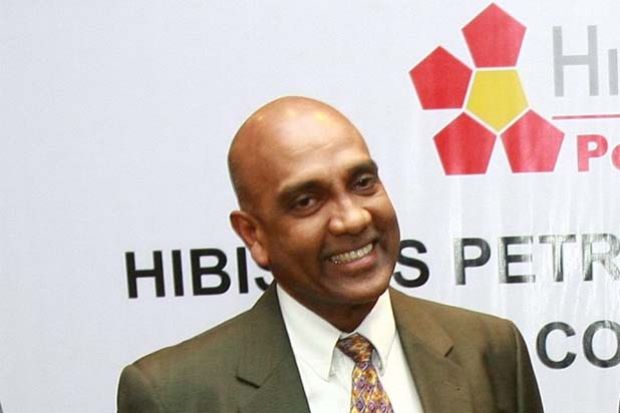

Hibiscus managing director Dr Kenneth Pereira said this is an opportunity for the company to increase its production levels.

“For 2019, the most important thing is to get the eight wells drilled safely. That should have some effect on the performance of the company.

“As for the longer term, we are doing a lot of work on our Marigold and Sunflower (Marigold) project,” he told StarBiz in an interview onf the sidelines of Invest Malaysia Kuala Lumpur 2019, hosted by Maybank with Bursa Malaysia.

Marigold is an asset in the UK North Sea purchased by Hibiscus in October last year.

Meanwhile, Pereira said Hibiscus’ objective for the next three years is to increase its production by more than 40% from its current level of 3 million barrels a year to 4.3 million barrels from its existing assets – Anasuria and North Sabah.

“This is before our Marigold project comes online. Marigold is a different dimension altogether. It will give us about 12,500 barrels a day if we maintain our 50% stake.

“We see certain value triggers coming up as far as the company is concerned and for us, we’re just focussed on trying to deliver them as cost effectively as possible,” he said.

Pereira said significant value accretion will accrue to the Marigold project in the delivery process towards the field development plan (FDP).

Hibiscus purchased Marigold for US$37.5mil and once the FDP approval is obtained from UK’s Oil and Gas Authority and the final investment decision is in place by December next year, the expected net valuation of the asset is US$240mil.

By the time Marigold starts producing oil in December 2022, the expected net valuation will be US$600mil.

Besides the US$75mil capex for the eight wells, Hibiscus will also be spending about US$5mil (RM20.30mil) for front end and engineering design (Feed) studies on the Marigold project.

“The work we’re doing on Marigold and Sunflower at this point in time between now and the end of 2020, we think it will add about US$150mil to the valuation of Marigold for our 50% stake.

“We think it will be north of US$200mil by the end of next year because of the ongoing works and the regulatory submissions which are going to be done soon.

“These add value to the licence and will add significant value to the company even before we start the execution phase offshore. It’s a very big step for our company so we’re working towards it. These are exciting times,” Pereira said.

On the company’s outlook, Pereira said Hibiscus is very optimistic about the financial year and is comfortable with the current oil prices, which have been good throughout the last 10 to 12 quarters.

Its financial year ends on June 30.

He added that Hibiscus focuses on keeping it costs low and also on its earnings before tax, interest, tax, depreciation and amortisation (Ebitda) margin – which is at the range of 60% at around oil prices of around US$60 per barrel.

“Oil prices are stable but there are obviously a lot of macro factors around all these ongoing trade discussions which sometimes cause short term movement oil prices.

“What you want is a stable situation. But eventually we feel that oil and gas are important components of the energy mix.

“Keep your cost low, control what you can and the rest you just have to leave it to what the macro factors are,” Pereira said.

On the proposed divestment of Norway’s Government Pension Fund Global (GPFG) from oil and gas exploration and production companies, Pereira said the sovereign wealth fund have progressively reduced their stake and it has been very orderly in the market.

“We understand why they do it from a strategy perspective. We thank them for being good shareholders for quite a long period actually. They supported us at an important time,” he said.

GPFG currently owns 2.02% stake in Hibiscus.

Source : TheStar