LoanCare: Check home loan eligibility with up to 10 banks

For an average income earning person, purchasing a home normally involves having to engage a bank for a home loan.

But if the application for the loan is rejected by the bank, the interested buyer will not be eligible to apply for another loan for a while as he could be locked out of the market for up to six months.

It is then important for potential home buyers to have access to more information before applying for a housing loan.

Many potential Malaysian home owners are unaware that different banks offer varying debt servicing ratios, or DSR, which shows how much a person’s income can be used to service debt instalments, which are represented as a percentage and is derived from two main components: a buyer’s commitment and income.

DSR amounts can differ between banks, despite it being based on the same information buyers provide and this is due to banks having their own DSR calculation methods.

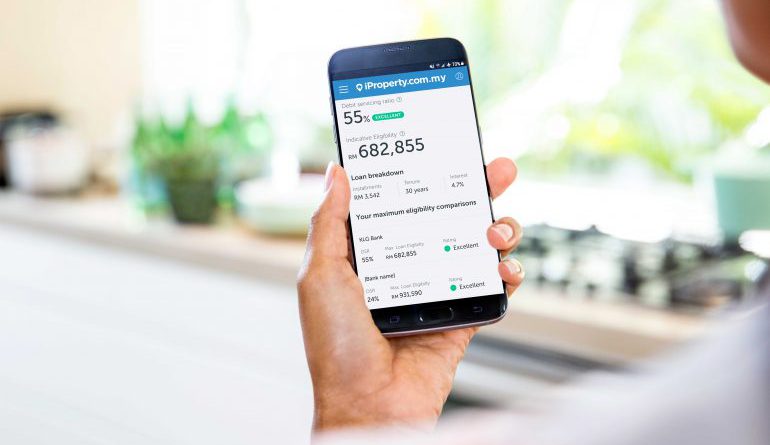

For that, iProperty.com.my has launched LoanCare – a home loan eligibility indicator which can help Malaysian home buyers increase their chances of getting a home loan and reduce the likelihood of rejection.

LoanCare is an indicator which allows users to find out detailed information about their indicative loan eligibility, as well as understand the home loan that best matches their needs.

It is a simple tool that compares and calculates home loan eligibility instantly with up to 10 banks, helping Malaysians increase their chances of getting a home loan.

Potential buyers can use LoanCare via iProperty’s website without needing to make visits to various banks, and unlike other home loan tools, the service does not require one to disclose his identity card number.

iProperty.com.my general manager David Mawer says the objective is to assist Malaysians by increasing their chances of home loan approval, which is in line with current government initiatives to assist home ownership and focus on affordability.

“Insights such as a maximum eligibility comparison with banks and individual DSRs should not be difficult to find,” he says. “Everyone deserves easy access to any and all information that will help them get the right home loan, without risking rejection.

“We are focused on helping people make better and more informed property decisions while bringing transparency to the home loan process. LoanCare, iProperty’s home loan eligibility indicator, is a free and simple way for Malaysians to increase their chances of getting a home loan,” says Mawer.

To access the LoanCare service, users just need to go to iproperty.com.my/home-loan-eligibility and provide information that will be used for calculating their financial status.

Users are then presented with a home loan eligibility report that lets them know the DSR each bank offers for their level of financing, how eligible they are for a home loan, and compare loans with up to 10 banks.

On iProperty.com.my, people can search for properties, either to buy or rent. It also connects property seekers to real estate agents and developers.

The website also offers offline solutions to customers and consumers with property-related events and expos. With more than two million visits a month, iProperty.com.my is the No.1 property portal in Malaysia.

For details on LoanCare or if you are looking for more on all things property, visit iProperty.com.my or download its app available on the App Store or Google Play.

Source : Star2