Get 50% tax deduction from property rental income

What are the possible deductions for owners with rental income who are not sure how to declare it for the year of assessment 2018? Are all expenses on the unit deductible? Here is a guide:

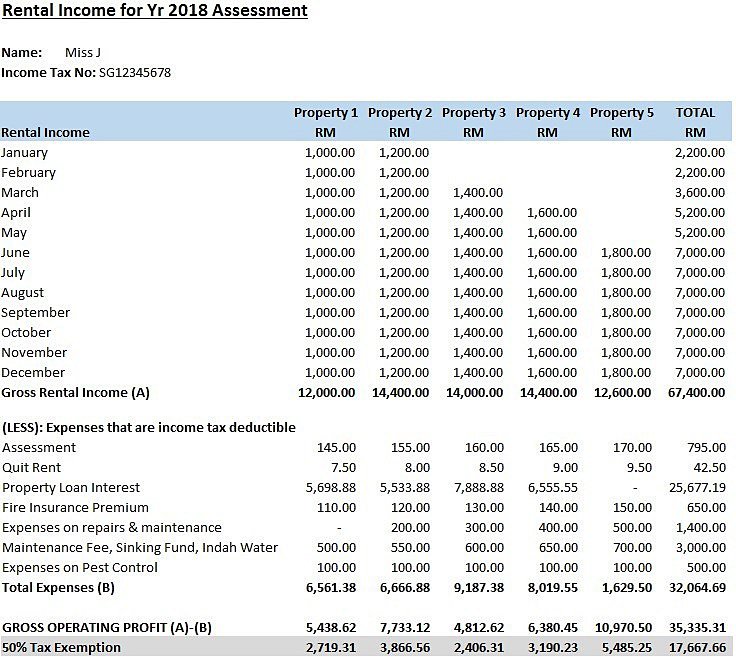

There’s no need for guesswork as there’s an easy to understand excel sheet reproduced below from Ms Jessica Jong, a leading mortgage management consultant, coach, trainer and speaker.

She shares a lot of important pointers on mortgage and how to save money on interest payments.

Income from renting out a residential home is given a 50% income tax exemption provided it meets the following conditions:

• The landlord is an individual citizen who resides in Malaysia and is the registered proprietor of the residential property;

• The amount of rental received per month from each residential property does not exceed RM2,000;

• The tenancy agreement between the landlord and the tenant has been executed, stamped and came into effect on or after 1 January 2018; and

• The residential property is rented out for any period from 1 January 2018 to 31 December 2018.

To declare the rental income for YA2018, please refer to the following FAQs:

Q1: What if the landlord rents out more than one unit of residential property?

A: If the landlord receives rent from more than one residential property, each residential property is treated as a separate source of rental.

Note: As mentioned above, one of the conditions to be eligible for the 50% tax exemption is that the amount of rental per month received from each residential property cannot exceed RM2,000.

Q2: How to file the rental income?

A: The landlord is granted an exemption under sub-paragraph 3(1) of the Order. It is important to maintain separate accounts for the rent received from each residential property. Source: income tax (exemption) (no.2) order 2019 [p.u. (a) 55/2019]

Please refer to the picture below for a sample on how to calculate rental income tax exemption

Source: FMT