6 reasons 2019 is still the best time to buy property

“When is the best time to buy a property?” is a very frequently asked question. Well, the best time to buy may have passed.

Take for example your parents. The best time for them may have been in 1988 when they bought a semi-detached home for RM85,000. Your brother may have bought a unit just behind them in 2016 for RM540,000. If only they bought a few units in 1988 instead of just one unit, right?

Perhaps for you personally the best time may have been in 2007. You bought a condo in Penang for RM247,000 (1,258sf with two car parks). You sold that condo in 2014 for RM640,000. If only you had bought a few units, right?

The point is, the best time for everyone may already have passed. However, 2019 can still be the second best time. This is a year when transactions will continue to be slow.

2019 is the year when the number of unsold units, usually unwanted units, will still be rising. This is also the year when everyone is unwilling to make a decision to buy.

Here are six reasons to take advantage of the second best time to buy a property:

1. Sellers and developers are more rational. You can now tell the owner nicely that you love their unit and make them an offer. The owner will be willing to consider your offer.

If this scenario was in 2012, the owner would have immediately rejected you. These days, developers prefer to earn a lower profit versus not selling and incurring a loss. Back in 2012 when the queue to buy was long, developers were definitely more arrogant.

2. Many choices to choose from. It’s not just the discounts in the primary market. It’s also the more flexible payment modes. It’s also the many more affordable new launches.

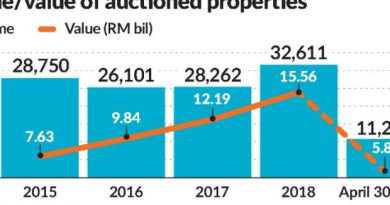

It’s also the lively secondary market as some owners want to sell and buy now because that property that they are eyeing is now cheaper. Even the property auction market is now quieter and this represents opportunities too.

3. Better and realistic prices. Property prices are good but not necessarily rock bottom in popular areas. In mature areas, the demand is always far higher than the available supply.

This is why prices will be resilient. Ask yourself if you own a home in a popular area and you are not in financial trouble, would you sell it at a rock bottom price today?

The answer is very clear. You will now be selling slightly lower than the usual transacted price but that’s the maximum you will go.

4. It’s just a cycle. Nothing lasts forever. There’s a cycle to everything. What’s up will come down and what’s down will go up again.

5. Bank loans are not the problem. You may have been led to believe that approval for loans are now so tough that no one can get their applications approved.

The fact is, banks need to lend. This is how they make profits. However they are now more prudent to whom they lend to.

Once the market adjusts itself and property prices and borrowers are aligned again, you will see loan approvals increase. The interest rates today are very attractive. Home loan rates were up to 14% in 1984 around 12% in 1998.

6. The economy is still resilient. Let’s face it. If the economy is in trouble, the property market will not survive. If the economy is in a crisis or when the unemployment rate is high, that spells trouble for the property market.

Without a stable job, who can buy property? As for a potential property bubble, current domestic signs are not pointing to that unless the world spins into another crisis.

There are many more reasons but these six should give you a good idea that although the best time for you has surely passed, 2019 is the best time to focus on your second chance.

If your question is should I still buy a property today, The answer is a yes. If your question is can I simply buy a property and expect the price to go up, then the answer is a no.

If you buy the wrong property, whether in good or bad times, it is still a wrong property. View, compare and evaluate carefully, then buy a good one and wait. Please do not keep waiting and later regret that you did not buy. Happy investing.

Source: FMT