Can Vacancy Tax help reduce property overhang in Malaysia?

The issue of vacancy tax is quite a hot topic in the property industry recently. It was first raised by Datuk Hasanuddin Mohd Yunus (PH-Hulu Langat) in the Parliament, questioning if the government will impose similar tax practices as seen in several other major cities around the world to address the number of unsold luxury condominium units in the Klang Valley. In answering the question, the Deputy Federal Territories Minister Datuk Seri Edmund Santhara Kumar stated that there is no need to impose such a tax now as the number of unsold luxury condominiums (priced over RM1 million) is low, but such a proposal would be studied further.

A week later, the Housing and Local Government Ministry (KPKT) announced that a vacancy tax is being formulated and could be imposed as early as next year on property developers who fail to sell their properties. According to KPKT, the introduction of such a tax could encourage property developers to be more responsible in the projection of their projects, particularly in high-rise developments, in order to reduce the overhang of residential units in the country. However, the Minister of Housing and Local Government – Zuraida Kamaruddin – mentioned on 27 August that KPKT is still studying the vacancy tax and has not made any decision on the matter. Previously, the proposal for the tax was made based on figures the ministry obtained showing that unsold units are priced at RM500,000 and above.

Judging from the chronology of the incident, as well as the responses given by the industry players through mass media, the issue of imposing a vacancy tax on property developers seems to be lessening. However, one should not forget that it could be brought up again in the future once the industry recovers from the current downturn. So, what exactly is a vacancy tax and how can it help?

What is vacancy tax?

In theory, a vacancy tax is imposed upon any property that is left vacant or unsold for a certain amount of time, based on a percentage of the gross selling price. It has been implemented in cities with high foreign ownership of residential properties, like Vancouver in Canada, Oakland and Washington DC in the US, and Melbourne in Australia; as an anti-hoarding initiative to avoid all unoccupied houses in the market to be sold or rented out speculatively. By imposing a vacancy tax on both the primary and secondary property, the issue of housing affordability is expected to be addressed, particularly in an undersupplied market.

Why is the proposed vacancy tax not favoured?

The vacancy tax that was proposed by KPKT is likely to take the form of “unsold property tax”, which will not only cause a fall of residential property prices across the board, but also degrades the homeowners’ welfare. This is because property developers will surely reduce the prices of their overhang units in order to avoid the vacancy tax; consequently, leading to a lower selling price and thereby affecting the market value of the secondary market housing. Since the country’s homeownership rate is as high as 76.9% – based on the latest statistics by DOSM – a fall in house prices will inevitably cause a negative equity to a majority of the rakyat.

On a longer-term, a vacancy tax is expected to exacerbate the problem of housing affordability and availability in the country. Property developers are expected to be much more conservative with their planning and development in the future, leading to a decline in property supply in the market. One should realise that when supply reduces, the demand will increase, leading to the shortage of houses that pushes up property prices – such basic economic forces of supply and demand cannot be overcome by the government’s intervention. In this sense, the necessity of imposing this vacancy tax needs to be considered deeply, especially from an economics perspective.

How helpful is the vacancy tax in mitigating property overhang?

As the current overhang situation is a culmination of various factors, which definitely cannot be solved by imposing taxes on the developers. Overhang is a problem that is mainly due to the unmet housing demand in association with the varying economic performance, housing preferences, market sentiment, housing affordability, credit accessibility, as well as demographics and lifestyle changes. It can only be addressed by a collaborative measure that involves all industry stakeholders. If the government aims to resolve the overhang problem holistically, a detailed study on the overhang situation is necessary.

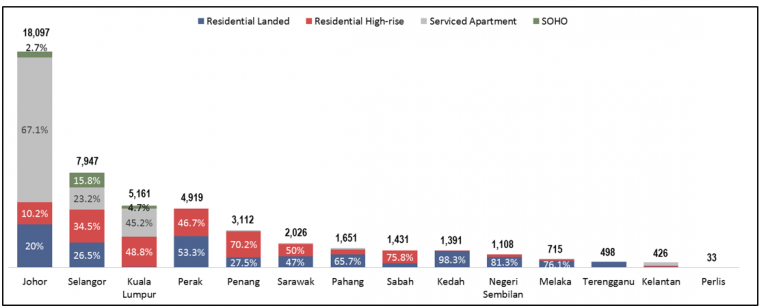

Based on the 1Q2020 NAPIC’s overhang statistics, the total number of overhang residential units – including both landed and high-rise – is 29,698 (Figure 1). As one can observe, overhang does not only happen in the high-end housing market segment but across the board. Surprisingly, houses priced below RM300k are the major contributor to overhang residential units (9,707 units or 32.7%), followed by houses priced at RM500k – RM1 million (8,623 units or 29%), RM300k – RM500k (7,492 units or 25.2%), and more than RM1 million (3,876 units or 13.1%).

Most of the overhang residential units priced below RM300k are houses built under the affordable housing schemes (i.e. PR1MA and RUMAWIP), which have been criticised for being located in less-appealing areas and with the wrong pricing. For example, in the case in Perak, as high as 70% of the residential overhangs are unit priced below RM300k, which are mainly contributed by PR1MA high-rise housing located in Falim, Meruraya, and Kampung Paloh. Another typical example is Kedah, where 48.7% of the residential overhangs are priced below RM300k, mainly contributed by PR1MA terrace houses located in Sungai Petani (Figure 2).

What would be a better solution instead to tackle property overhang?

These houses are likely to remain in the overhang category for the next couple of years or even longer, as a result of overbuilding housing products that are mismatched with the local demand. If the vacancy tax was to be imposed upon all overhang units across the board, houses that are built under the government’s affordable housing schemes are most likely to be affected significantly. Therefore, a more targeted approach is needed to resolve the overhang problem without causing unnecessary disruption to the market.

The inclusion of commercial-titled residences – serviced apartments and SOHO – into the calculation of residential overhangs sees the intensifying property glut in the country. The total number of overhangs, encompassing both residential- and commercial-titled residences, recorded at 48,619 units; where as high as 16,942 units or 34.8% are contributed by serviced apartment; while SOHO is contributing 1,979 unit or 4.1% (Figure 1). Particularly in states like Johor, Kuala Lumpur, and Selangor, serviced apartments account for a significant portion of overhangs, which is as high as 67.1%, 45.2%, and 23.2%, respectively (Figure 3).

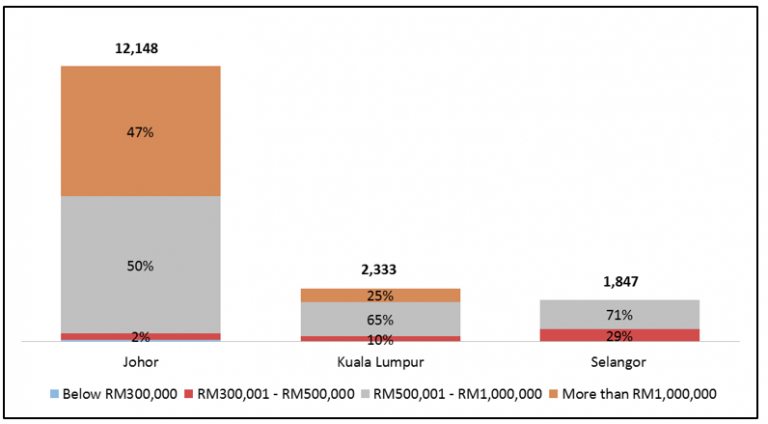

A further study on the serviced apartment overhangs in Johor shows that the major contributors are products priced at RM500k – RM1 million (50%) and above RM1 million (47%); which is in contrast to Kuala Lumpur and Selangor where major contributors are by products priced at RM500k – RM1 million (Figure 4).

Also, the differences of overhangs between Johor and the other two states are quite substantial, which is mainly due to the desire of property developers to capitalise on foreign buyers and a lack of coordination on planning amongst local authorities. This, again, indicates that overhang is a specific and localised problem, which can only be solved with a more targeted approach – such as the Johor state government’s move to freeze applications for the development of serviced apartments rather than imposing penalised taxes across the board.

The holistic measure that has to be adopted, at this moment, is to ensure a better information flow on the property market among industry players. Following the outbreak of COVID-19, a softer property market is observed and a buyers’ market is prevailing. It is expected that buyers in the post-MCO era will be more price-conscious, and will likely place more emphasis on housing location that benefits their quality of life in the long run. Therefore, rather than relying on market-spurring initiatives to boost the sales and to drum up the buying sentiment, property developers should go back to the fundamental principles of property development – the dynamic trade-off relationship among house price, size, and location – when determining what types of products to be released, and which group of buyers they are targeting on.

This shows that there is a need for an integrated housing database that consolidates data from multiple agencies at federal, state, and local levels – in order to not only help industry players to gauge the latest market trends, but also provide a better understanding on how new launches perform in matching the local affordability level; thereby ensuring the availability of an adequate supply and diversity of housing opportunities in the country.

Source: iProperty