The Johor-Singapore relationship remains significant in driving property demand

The high-rise residential sub-sector in Johor is expected to remain sluggish moving forward as potential buyers and investors adopt the ‘wait-and-see’ approach.

Knight Frank Malaysia said the resurgence of Covid-19 cases more than a year since the implementation of the first Movement Control Order (MCO) continues to impact the property market.

It said the overall high-rise residential properties in the secondary market experienced fluctuations in asking prices due to mixed sentiments arising from the strict containment measures.

“The Johor-Singapore relationship remains significant in driving demand and most investors, developers, and business owners are looking forward to the re-opening of international borders,” said the firm.

The cumulative investment for Iskandar Malaysia, since its inception in 2006, was recorded at RM340.3 billion as of December 2020. Some 60 per cent or RM202.2 billion has been realised, comprising 59 per cent of domestic investment and 41 per cent foreign investment. China topped with the highest investment value of RM54.6 billion, followed by Singapore (RM24.3 billion), United States (RM8.39 billion), and Japan (RM5.86 billion).

There were some major land deals by developers in Johor in 1H2021.

On January 5, 2021, Kimlun Corp Bhd proposed to acquire 4.54 hectares (ha) of commercial land in Bandar Seri Alam for RM40.5 million or about RM83.60 per square ft (psf) to replenish its land bank. As at the date of announcement, details and specific plans for the proposed commercial development are still at the preliminary stage.

On April 22, 2021, Damansara Realty Bhd inked a SPA agreement with DMR Land Sdn Bhd to dispose of two parcels of freehold land measuring 4.81ha in Taman Damansara Aliff, Johor Bahru for RM38.42 million or about RM75 psf.

On May 7, 2021, S P Setia Bhd, through its wholly-owned subsidiary, Pelangi Sdn Bhd disposed of eight parcels of land measuring about 391.72ha in Mukim Tebrau for a total of RM518.15 million.

According to Knight Frank’s latest publication, the Real Estate Highlights 1st half of 2021 (1H2021), as of 1Q2021, the cumulative supply of high-rise residential property in Johor Bahru stood at 141,728 units, reflecting an annual increase of 4.2 per cent from 1Q2020.

Market activity fluctuated during the review period due to various tightening and relaxation of the MCO and the introduction of the four-phase National Recovery Plan (NRP) to contain the spread of the virus.

Despite the overall challenges some developers continued to launch new projects in 2021.

MB Group launched Trellis Residences in April 2021. It offers 1,737 units in four layouts, namely studio (295 sq ft), one-bedroom (435 sq ft), two-bedroom (697 sq ft), and dual-key (1,001 sq ft) with selling prices starting from RM220,000 to RM623,000 per unit. The project has an estimated gross development value (GDV) of RM539 million and forms part of the MBW City mixed-use development.

Knight Frank said the incoming office supply of 1.77 million sq ft in the near future is expected to increase competition in Johor Bahru’s office market, putting pressure on occupancy level.

The cumulative supply of purpose-built office space (privately-owned) in Johor Bahru stood at 8.5 million sq ft as of 1Q2021, reflecting a 6.2 per cent year-on-year increment (1Q2020: 8 million sq ft) following the completion of Carnelian Office Tower in Forest City.

Knight Frank noted that Carnelian Office Tower is not officially launched to the public yet.

Notable incoming supplies such as Sunway Big Box Office, Coronation Square Office Tower @ Ibrahim International Business District, Menara UMLand, and Mid Valley Southkey Office will collectively add circa 1.77 million sq ft to the cumulative stock.

The Mid Valley Southkey Office, which is located at the city fringe, is scheduled to complete by 4Q2021, the firm said.

Knight Frank said during the year, the overall occupancy rate of purpose-built office space edged higher to record at 69.2 per cent (2019: 68 per cent) after two consecutive years of decline.

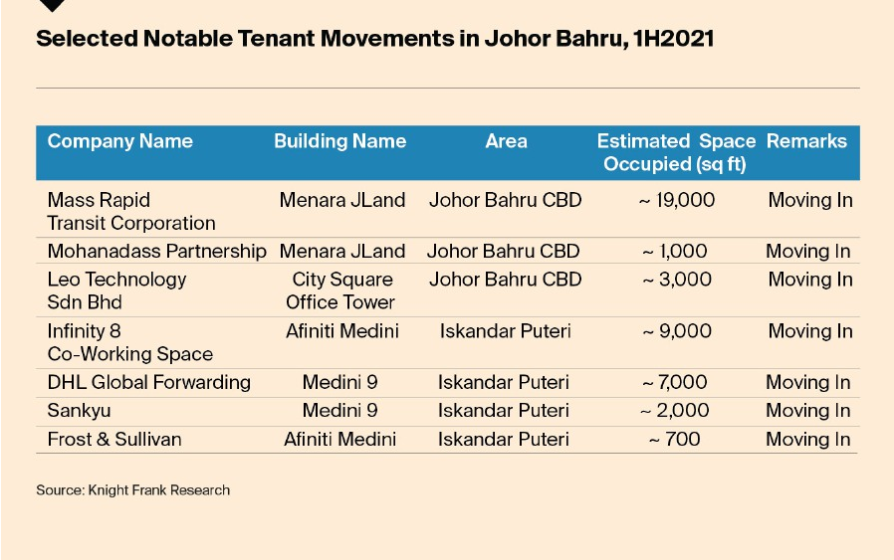

“Amid the protracted pandemic, there is increased interest in co-working space as its flexibility allows companies to scale up and down during the various phases of MCO where employees are encouraged to work remotely,” it said.

In Johor Bahru city centre and Johor Bahru city fringe, asking rental rates were lower and range from about RM2.40 psf to RM3.20 psf per month as retaining tenants and boosting occupancy levels are key to landlords.

Similarly, at Iskandar Puteri, the monthly asking rentals also declined and were quoted from RM3.00 psf to RM3.50 psft, the firm said.

Knight Frank said the retail segment is one of the worst-hit sectors attributed to restrictions in domestic movement, inter-state travel ban, and closure of international borders.

As of 1Q2021, the cumulative supply of retail space in Johor Bahru was recorded at about 20.8 million sq ft while the overall occupancy rate was lower during the year at 74.4 per cent (1Q2020: 79.3 per cent).

“Many retailers had to restructure their business operations by downsizing or permanently closing their underperforming outlets. Small retailers may also shift their business operations online to reduce operational costs which include rental of physical stores whilst optimistic retailers have seen this as an opportunity to take over strategic prime space at more affordable rates,” it said.

After six years of operations, Angry Birds Theme Park, which occupied about 25,994 sq ft of space within KOMTAR JBCC, officially shut down on April 5, 2021.

On the industrial sub-sector, Knight Frank said that despite the current pandemic, it is expected to remain resilient with a higher level of market activity.

Nevertheless, there were some interesting deals that took place in the first half of 2021.

On March 5, 2021, Acoustech Bhd, through its wholly-owned subsidiary, Teras Eco Sdn Bhd entered into a sales and purchase (SPA) agreement with Pegasus Advance Engineering Sdn Bhd to dispose of a piece of industrial land located at Tanjung Surat, Kota Tinggi for RM6.4 million, or about RM45 psf.

AXIS Real Estate Investment Trust also inked a SPA agreement with Xin Hwa Trading and Transport Sdn Bhd, a unit of Xin Hwa Holdings Bhd in March to acquire land with buildings located in the Pasir Gudang Industrial Area, Johor, for RM75 million.

Source: NST