Locally assembled cars may cost more

PETALING JAYA: Locally assembled vehicles may cost more following the potential restructuring of auto duty rates by the government.

While it is still unclear on how the new rates will eventually affect overall duties for cars, a source familiar with the matter said the prices of locally assembled cars could see a price hike.

“With the excise duty gazette released on Dec 31, completely-knocked-down (CKD) vehicles will most likely be liable to pay more taxes. We are still analysing the impact, ” he told StarBiz.

According to reports, Finance Minister Lim Guan Eng had said that the Finance Ministry and International Trade and Industry Ministry were in discussions to restructure car import duties, with a joint committee studying the matter.

RHB Research in a report said it is unclear how the review will affect overall duties for cars at this juncture, noting however that higher car prices will be politically unpopular.

It pointed out that a potential hike in vehicle prices may likely lead to lower car sales, given the current soft consumer sentiment.

“In the Pakatan Harapan election manifesto, it promised to reduce the excise duty on imported cars below 1,600cc engines for first-car buyers with household income below RM8,000 a month.

“However, lower car prices will not mean higher car sales immediately and could bring about other unintended consequences.”

One industry observer pointed out that a large proportion of cars sold in Malaysia are CKD.

“This will make completely-built-up (CBU) cars more attractive but their approved permits cannot exceed 10% of CKD total industry volume (TIV).”

Under the Asean Free-Trade Area Agreement, import duties on CKD and CBU vehicles from Asean countries have been reduced to 0%. For vehicles from non-Asean countries, the import duties on CKD cars have been reduced to 10%, while import duties on CBU vehicles were reduced to 30%.

The industry observer reckoned that the tax structure may have been reviewed because local CKD vehicle manufacturers have been known to under-declare their foreign content levels and “escape with huge profits”.

Another industry observer said increasing car prices would be a politically unpopular move.

“In any case, if this happens, it will benefit national brands due to their lower price points. However, it will deter foreign direct investments into the industry, ” he said.

RHB Research said while lowering car prices would lead to longer-term positives, the research house added that this too could have a negative impact on the industry eventually.

“The objective to lower car prices is achievable in the medium term. The overnight implementation of lower new car prices could result in a significant upheaval for car residual values, until the market is able to fully digest the changes.

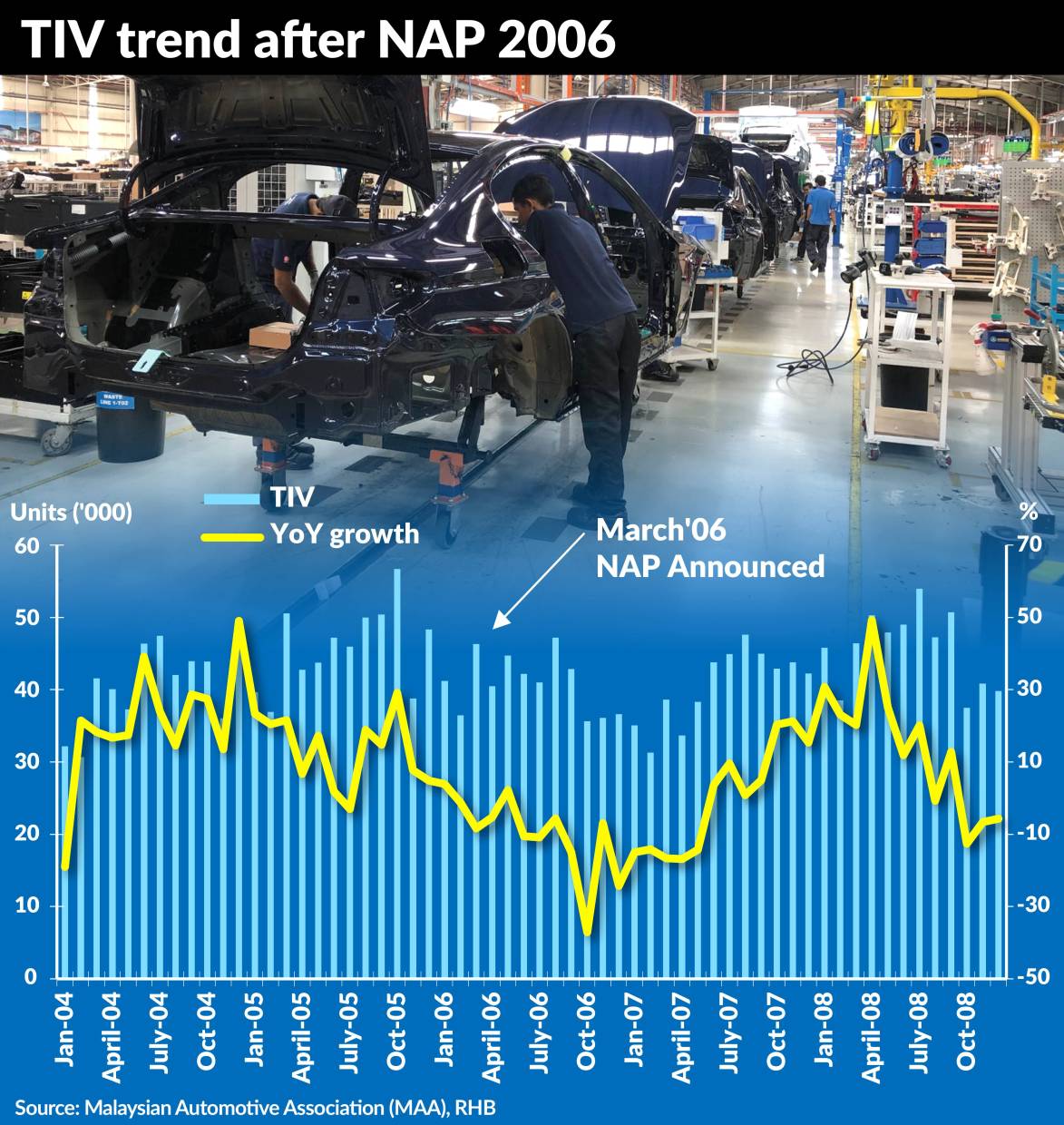

“A change in the duty structure arising from revisions contained in 2006 National Automotive Policy (NAP) resulted in a collapse in new car sales and it took more than 12 months for the market to recover to pre-NAP TIV sales levels.

“Non-national marques could be affected the most since national marques, in general, have lower effective excise duties from higher local content. For the initiative to be effective, the government also needs to make sure that savings from the duty reduction are passed to consumers, as opposed to distributors using it to improve margins.”

RHB Research added that new car sales will suffer in the short run.

“We expect to see consumers postpone purchases as the new prices take effect. The resulting correction in used car residuals, due to lower new car prices, would also affect new car sales due to the erosion of the equity value embedded in used car residuals, which car buyers typically usually use as a down payment when buying new cars.

“The banking sector could see an uptick in impairments, if there is a significant correction in used car residuals as collateral value falls short of the outstanding loan value.”

Ultimately, the research house said the potential restructuring of duty rates on automobiles is a significant regulatory risk.

“We maintain our 2020 TIV forecast of 595,000 units (a 1% year-on-year decrease), pending further details on the regulatory changes. Pending clarity on this, investors will likely stay cautious on the sector, ” it said.

According to the latest data from the Malaysian Automotive Association (MAA), year-to-date November vehicle sales was flattish at 549,445 units compared with 550,410 units in the previous corresponding period.

The MAA will announce last year’s TIV figures later this month. At its biannual media conference in July last year, the association maintained its 600,000 units TIV forecast for 2019, in light of the economic uncertainties.

MAA president Datuk Aishah Ahmad said consumers and businesses were expected to remain cautious going into the second half of 2019, adding that this would only spur aggressive promotional campaigns by local car companies.

Source: TheStar