Overhang due to zealous building and launching without property planning

The current overhang in Malaysia is due to zealous building and launching by property developers without proper analysis and only they can help solve this.

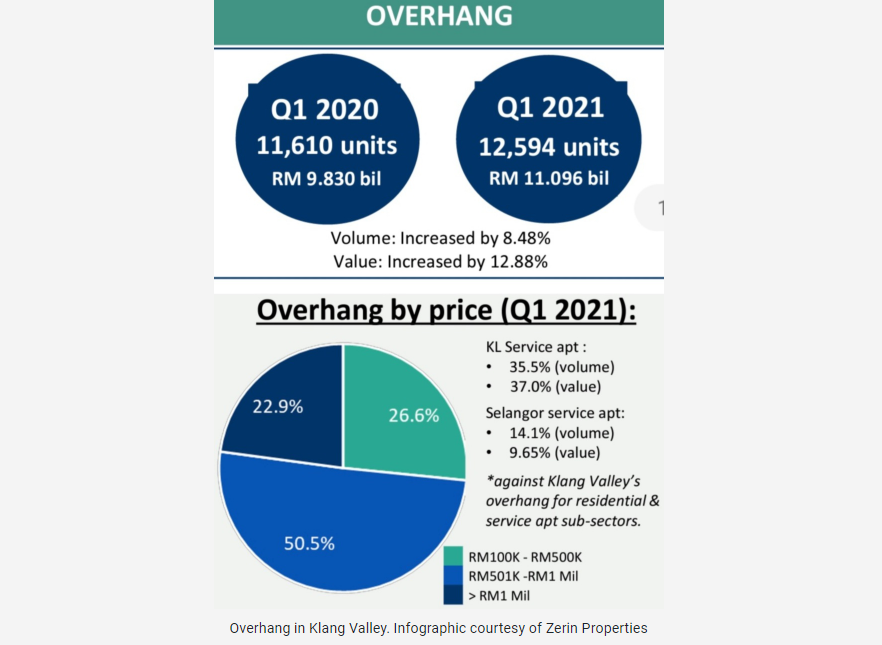

The overhang in Klang Valley grew by 8.48 per cent in terms of the number of units or 12.88 per cent in terms of value.

“The problem then was just enthusiastic building and launching without proper market studies analysis of what the buyers want and can afford. All this of course was already in the change but was accelerated in early 2021,” said Zerin Properties group chief executive officer and founder Previndran Singhe.

Previndran said the majority of the overhang units were residential properties as opposed to serviced apartments in the RM500,000 to RM1 million range.

“For me, this overhang is a past legacy. It was around pre-Covid days and will be around unless corrective action is taken by the developers themselves,” he said.

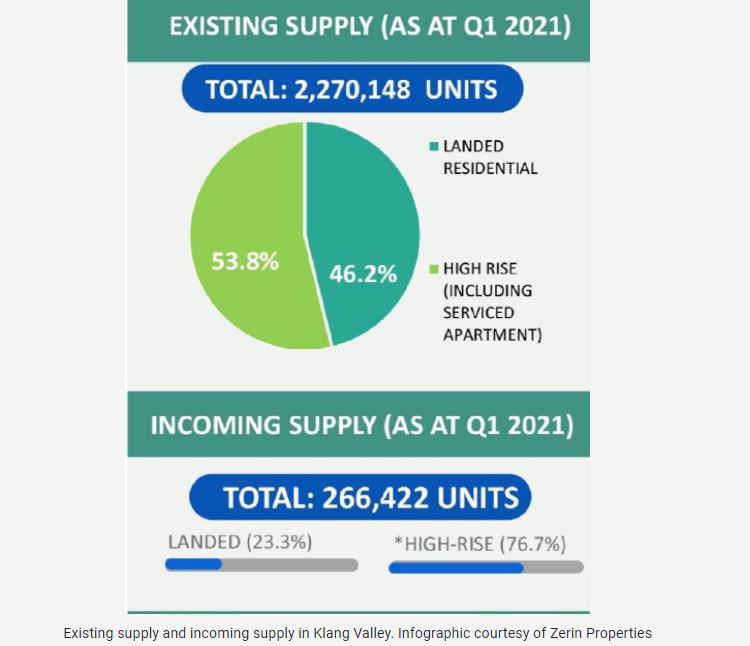

Previndran said despite the ongoing pandemic, the demand for residential properties in Klang Valley remained steady.

He said mortgage approval trends continue to rise and there are more sales as developers have become creative at driving sales.

The steady demand for residential properties was mainly driven by strong digitalisation by the developers, price readjustment to suit buyers’ affordability, and new launches that catered to what the market wanted.

Previndran said demand was further boosted with Bank Negara maintaining the record-low overnight policy rate of 1.75 per cent, and the ongoing Home Ownership Campaign which ends on December 31, 2021.

He said in terms of the value of transactions, there was a growth of about 28 per cent in the first quarter of 2021 (Q12021) as compared to Q12020.

In terms of volume, there was an increase of about 19.5 per cent in Q12021 as compared to Q12020.

“We truly have a resilient market. I think the important point to note is Q12021 is actually just before the MCO (Movement Control Order) whilst the numbers you see in Q42020 and Q12021 are after MCO, truly reflecting a strong and pent-up demand of buyers,” said Previndran.

Previndran said what his firm is observing is that the high net-worth individuals (HNWI) and ultra HNWIs are still very active in the market.

“They are paying top dollar for properties that otherwise would not be in the market, and they are also looking at opportunistic deals in high-end locations. The main artery and the pump of the residential market are properties priced below RM500,000 which are sort after by our bourgeoning middle-class market,” he said.

Previndran said there also seems to be a “pricing overhaul” of the overhang, where developers with inventory that have not been moving are going into the market at discounts ranging up to 45 per cent.

Meanwhile, the Iskandar market is the most hit market in Malaysia with its overhang close to double Klang Valley.

Previndran said that last year the overhang in Iskandar grew three times more as compared to Klang Valley by 27.94 per cent in terms of the number of units.

“Again, like Klang Valley, I do see it increase next year as the properties launched in 2019, which were already part of the problem, come into the picture,” he said.

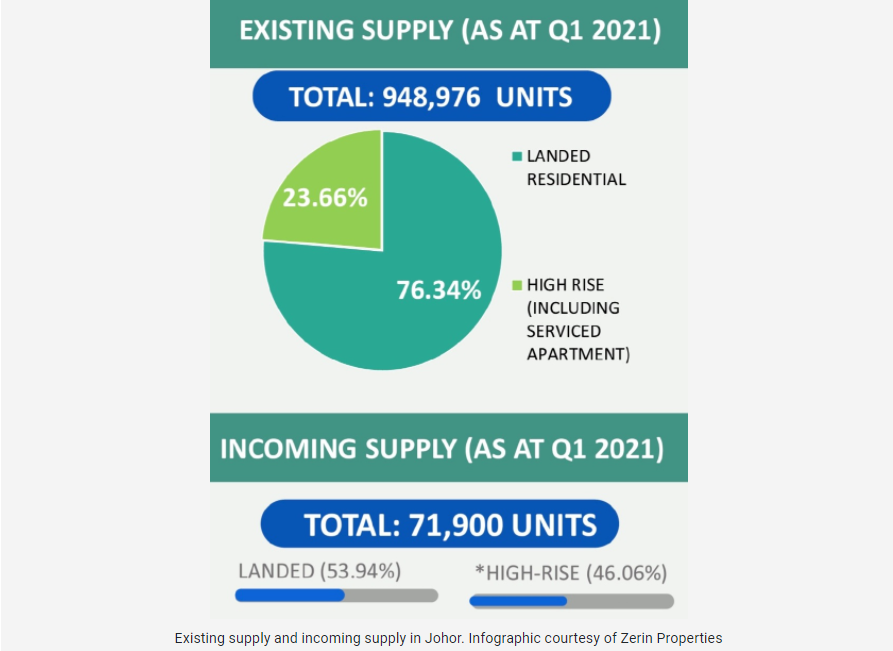

In Iskandar, 73 per cent of the overhang are serviced apartments and in the RM500,000 to RM1 million range.

“I think the very astute Johor developers saw this coming and switched to landed properties very quickly as you can see from the incoming supply, planned supply, and new planned supply, which is 100 per cent landed. This has also resulted in very good sales, as you can observe the sales numbers in Q12020 as compared to Q42020.

“However when we compare Q12020 to Q12021, in terms of the number of units, there was a drop of 10 per cent, but in terms of value, it increased to by about four per cent. Our research shows a lot of residential properties and well-located condos were picked up mainly by locals,” said Previndran.

Source: NST