Malaysia’s external debt fell to 66.2% of GDP at end Q3 2018

KUALA LUMPUR: Malaysia’s total external debt declined to 66.2% of gross domestic product (GDP) as at end-Q3, 2018 from a peak of 74.3% of GDP as at end-2016.

Bank Negara said on Friday that the bulk of the external debt was by corporations and banks.

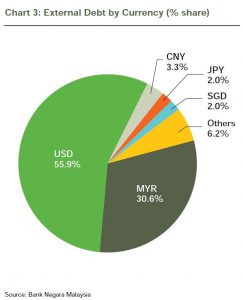

“Foreign currency-denominated external debt stood at 46.0% of GDP as at end-Q3 2018, compared to the highest level of 60.0% of GDP during the 1997 Asian Financial Crisis,” it said in a report on the country’s external debt.

The report said the government’s foreign-currency denominated external debt was very low (1.2% of GDP).

While risks surrounding external financing conditions have increased, risks to Malaysia’s external debt, including short-term external debt, remain manageable. This was anchored by a favourable external debt profile and borrowers’ resilient repayment capacity.

Bank Negara said due to the progressive liberalisation of Malaysia’s foreign exchange administration rules and the decentralisation of international reserves, Malaysian entities have accumulated signifi cant external assets abroad.

“Of signifi cance, Malaysia’s non-reserve external assets have doubled from RM622bil as at end-2010 to RM1.3 trillion as at end-3Q 2018. Domestic corporations and banks now hold about three-quarters of Malaysia’s RM1.7 trillion external assets.

“This accumulation has contributed to Malaysia having a net foreign currency asset position. This provides a defence against sharp exchange rate depreciation.

“Crucially, these assets can be drawn upon to meet borrowers’ external debt obligations without creating a claim on Bank Negara’s international reserves,” it said.

Source: TheStar