Market rat-tled by coronavirus

PETALING JAYA: The local market continued its rocky start to the Year of the Rat with experts anticipating more volatility in the days ahead, comparing it to what happened in the previous SARS outbreak.FBM KLCI ended the day 0.08% lower at 1550.47 points, after taking a beating the previous day when it shed 21.17 points to its lowest level since October last year on fears over the fast-spreading coronavirus.

Overall sentiment appeared to be mixed, with gainers outnumbering decliners at a ratio of five to four.

Yesterday, glovemakers, as well as hospital and healthcare-related players, saw their share prices dip slightly after surging the previous day, while airport and tourism counters saw some recovery following the initial sell-off.

Glove manufacturers had seen their share prices spike in anticipation of a surge in demand for medical gloves, especially as the Malaysian Rubber Glove Manufacturers Association (MARGMA) announced an urgent request from China for more medical gloves.

Yesterday, Top Glove shed 2.67% to close at RM5.84 while Supermax Corp Bhd closed 4.3% lower at RM1.78

Malaysia Airport Holdings Bhd (MAHB), on the other hand, recovered some of the previous day’s losses, closing 4.87% higher at RM6.68.

In the region, Hong Kong fell more than 2% when it reopened for trading yesterday, later dwindling further to end the day 3.26% lower.

Elsewhere, Singapore and South Korea, which were the region’s worst hit on Tuesday, showed some recovery, ending the day 0.11% and 0.39% higher.

Looking ahead, experts say they foresee further volatility as the number of coronavirus cases is expected to continue rising before it peaks, and a recovery is finally seen.

Renowned Chinese respiratory expert Zhong Nanshan, in an interview with Xinhua, said the novel coronavirus (2019-nCoV) outbreak is likely to peak in a week or about 10 days.

“It is very difficult to definitely estimate when the outbreak reaches its peak. But I think in one week or about 10 days, it will reach the climax and then there will be no large scale increases, ” Zhong, who heads a national team of experts set up for the control and prevention of the novel coronavirus-caused pneumonia, was quoted as saying.

In essence, the view is that the worst is not over in terms of the spread of the virus, as well as its impact on markets.

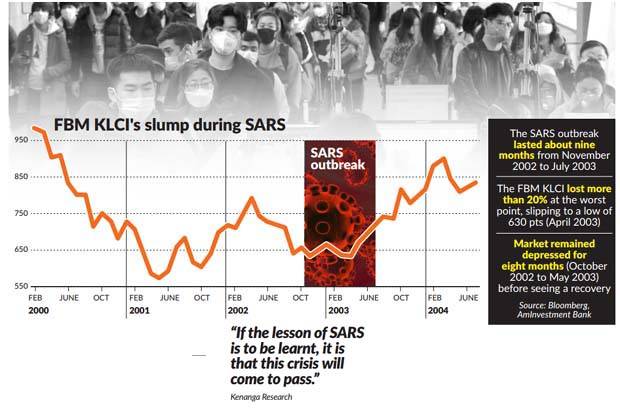

The potential impact of the coronavirus outbreak on markets has been widely compared to another global pandemic in recent times – the Severe Acute Respiratory Syndrome (SARS) in 2002 and 2003.

In 2002, SARS had spread to 37 countries, infecting more than 8,000 people and killing more than 750.

An AmInvestment Bank report noted that the FBM KLCI, during the epidemic, had lost more than 20% at the worst point of the outbreak, staying depressed for eight months between October 2002 to May 2013 at 630-671 points (pts). After the epidemic was declared over, however, the FBM KLCI gained a hefty 231 points or 34% over the next nine to 12 months, rising to 902 points in March 2004.

AmInvestment Bank, in its market report, said it believes the latest coronavirus outbreak will delay, but will not derail, a potential market rerating in 2020.

This, it said, was driven by catalysts including investors’ increased appetite for risk assets, particularly emerging market equities, a change in Malaysia’s perceived country risk premium following significant political events and a play on the ringgit.

“While we are positive on the outlook for the market over the next 12 months, we believe investors should exercise caution over the next three to six months as it appears that the current 2019-nCoV outbreak will not go away or taper off anytime soon, and it will probably get worse before it gets better, ” it said in a note.

It added that key stock markets in most parts of the world had been scaling record highs since the beginning of the year, leaving investors with plenty of room to take profits.

The downside risk to the local market, however, is more limited given FBM KLCI’s major underperformance in 2019, it said.

Kenanga Research was on the same page, expecting heightened market volatility ahead as the number of confirmed coronavirus cases potentially rise sharply in coming days.

Specific to Malaysia, it said Visit Malaysia Year 2020 will be the worst impacted, likely throughout the first half of the year, given that tourists from China make up the third largest arrivals and are a main target for this year’s campaign.

“However, if the lesson of SARS is to be learnt, it is that this crisis will come to pass, ” it said. The research house added that the current episode was a buying opportunity for those insufficiently positioned in equities.

Source: TheStar