Using land value capture to beat land hoarding

LAND value capture is a rarely discussed policy tool. Interestingly, this was brought up at session at the Malaysia Urban Forum 2019. The idea is to capture increments in land value for urban regeneration.

What is land value capture? The Lincoln Land Institute Policy defines value capture “as a process by which a portion of increments in land value attributed to community interventions, rather than landowner actions, is recouped by the public sector and used for public purposes. These unearned increments may be captured through their conversion to public revenues as taxes, fees, exactions or other fiscal means, or directly through on-site improvements to benefit the community.”

The idea is to discourage land hoarding by developers and landowners.

Land is now taxed at a minimal rate, encouraging owners to hoard the land and wait until the value of the land increases before it is developed.

Land hoarding has been discussed since the late 19th century by Henry George, who recommended the use of rent capture such as land value tax.

He argued that firms and individuals should not enjoy appreciation in asset value due to investment in infrastructure by the government.

For example, the government builds light rail transit and mass rapid transit extensions. These investments increase the value of the land along the lines, profiting the owners of the land.

In this case, the government should recoup its investment by taxing the owners of the land.

Winston Churchill, in his speech to the House of Commons in 1909, described this issue: “Roads are made, streets are made, services are improved, electric light turns night into day, water is brought from reservoirs a hundred miles off in the mountains — and all the while the landlord sits still.

“Every one of those improvements is affected by the labour and cost of other people and the taxpayers. To not one of those improvements does the land monopolist, as a land monopolist, contribute, and yet by every one of them the value of his land is enhanced.

“He renders no service to the community, he contributes nothing to the general welfare, he contributes nothing to the process from which his own enrichment is derived.”

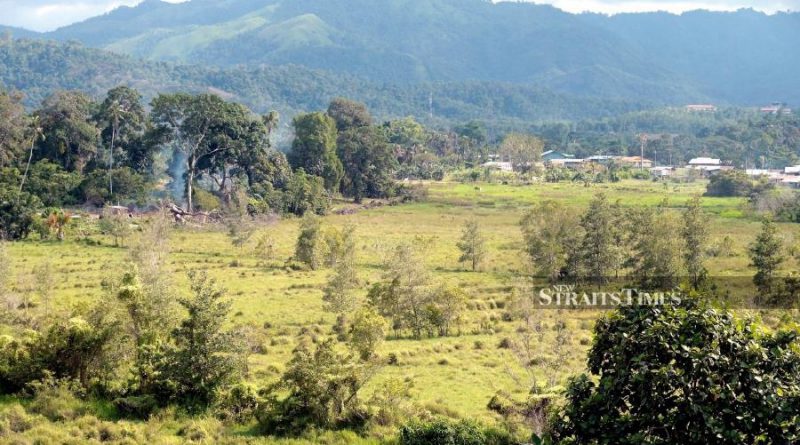

Corporations invest in land, and hoard it, waiting for the right opportunity to unlock the land’s value. Some invest in plantations. However, when governments invest in infrastructure, for example highways, these companies will unlock the land and build property.

The corporations will use the current market value of the land, instead of the book value of the land.

These companies are making profit in two ways: profit from property development, as well as profit from the escalating value of the land.

In Buku Harapan, the issue of land hoarding was discussed.

Action by big developers, including government-linked companies which do land banking, resulted in a surge in land prices, which contributed to higher house prices.

In its manifesto, Pakatan Harapan pledged to set a time limit within which developers must develop the land. This is to ensure that no corporations can hoard land.

Essentially, land value capture tax can be used to achieve three goals.

FIRST, to discourage land hoarding, which may contribute to increasing supply of affordable properties and lower land prices;

SECOND, proceeds from this value capture can be used to finance more affordable housing initiatives and other needs of the community; and,

THIRD, the proceeds can be used by local councils for infrastructure development.

Source : NST