Zafrul: Worst is over for Malaysian capital market

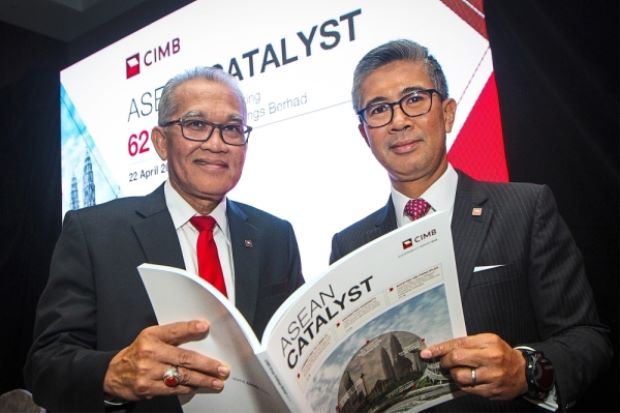

KUALA LUMPUR: The worst is over for the Malaysian capital market, which has been spooked by the country’s potential disqualification from an important global bond index, according to CIMB Group Holdings Bhd group chief executive officer Tengku Datuk Seri Zafrul Aziz.

Speaking to reporters after the banking group’s annual general meeting, Tengku Zafrul said he was optimistic that Malaysia would be retained under FTSE Russell’s World Government Bond Index (WGBI), given the country’s role in the global bond market.This is expected to boost investor confidence in the domestic capital market.

He believes that index provider FTSE Russell will be convinced about Malaysia’s participation in the WGBI, with the engagement between FTSE Russell and the government over the review period of the next six months.

Tengku Zafrul’s comments on the WGBI came a few days after RHB Banking Group managing director Datuk Khairussaleh Ramli said the potential exclusion from WGBI is unlikely to have a material impact on Malaysia.

“The recent selloff in our markets was a result of investors’ knee-jerk reaction, as they turned more cautious on the news of the potential exclusion from the index. However, our bond market performance year-to-date is still positive.

“Once FTSE Russell starts to talk to all the players during the review period, I am sure they will agree that we should remain on the index. There will be some outflow from the market until a decision is made, as investors will prefer to stay on the sidelines. But generally, we have seen the worst already,” said Tengku Zafrul.

On April 15, FTSE Russell announced that Malaysia had been placed on its fixed-income watch list for six months until September 2019, following the completion of its first fixed-income country classification review.

“Malaysia, currently assigned a ‘2’ and included in the WGBI since 2004, is being considered for a potential downgrade to ‘1’, which would render Malaysia ineligible for inclusion in the WGBI,” said FTSE Russell in a statement.

FTSE Russell’s move to review Malaysian government bonds’ participation in the WGBI came a week after Norway’s US$1 trillion sovereign wealth fund was told to cut emerging-market government and corporate bonds, which includes Malaysia.

Tengku Zafrul was also optimistic about Malaysia’s economic growth trajectory and the outlook of the ringgit for full-year 2019.

“We maintain our forecast for the economic growth to be around 4.5% to 4.7% and we are also looking at the ringgit to strengthen to RM4.10 per US dollar by year-end,” he said.

Meanwhile, Tengku Zafrul pointed out that CIMB Group was working on at least three initial public offerings (IPOs) this year. The three IPOs are within the infrastructure and consumer sectors.

“We have a few in the pipeline which we hope will happen this year. The size would depend on the valuations,” he said, adding that CIMB Group was not involved in any IPO exercise in 2017.

On the banking group’s expected capital expenditure for financial year 2019, Tengku Zafrul said about RM900mil has been allocated to enhance its information technology (IT) and operations.

“We are increasing our investments in terms of IT and operations and so, we are going to triple our investments in these areas for resiliency and also for future-proofing the business.

“Given this, we are expecting a flat return on equity for 2019 as we are going to invest this year,” he added.

Source : TheStar