Consumer confidence stabilising

PETALING JAYA: Confidence level among consumers in the country may stabilise this year after hitting an all-time high in the third quarter of 2018.

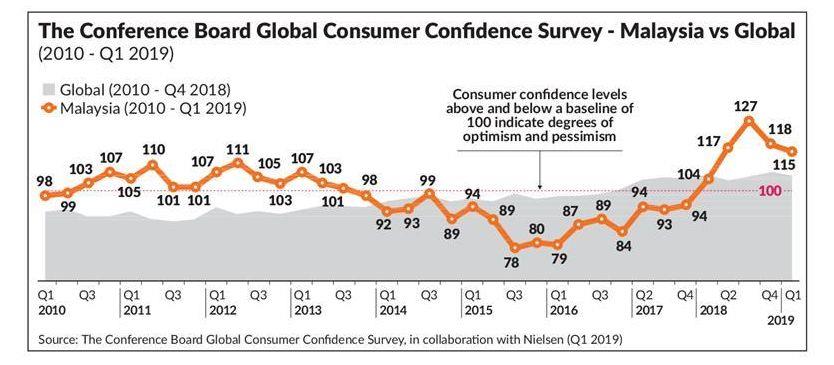

Based on Nielsen’s latest findings in collaboration with The Conference Board Global Consumer Confidence Survey, Malaysia was ranked sixth globally on the Consumer Confidence Index (CCI), with an index score of 115 points in the first quarter of 2019, in-line with last quarter’s score of 118 points.

This was the fifth consecutive quarter of consumer optimism for Malaysia. Consumer confidence levels above and below 100 indicate degrees of optimism and pessimism, respectively.

Nielsen Malaysia managing director Luca De Nard described consumer confidence level in the country for this year as “normalising”.

“We can expect to see confidence level normalising as people adjust to the ‘new normal’ under this new administration, barring any extraordinary events that could cause material shifts in confidence level,” he told StarBiz.

“The euphoria surrounding the historic general election caused a spike in consumer confidence in 2018, as messages of change and hope resonated with many Malaysians, therefore positively impacting their perception on job prospects, personal finances and readiness to spend,” he said.

However, De Nard noted that this heightened sense of optimism was not sustainable, as people hungry for change expect, reasonably or unreasonably, to see results immediately.

Since coming into power, he said the new administration has highlighted the bigger-than-expected budget deficit faced by the nation, which has somewhat overshadowed other positive economic indicators such as low unemployment, low inflation as well as healthy gross domestic product (GDP) and fast-moving consumer goods growth.

With conversations surrounding austerity and financial “sacrifices” dominating the headlines, De Nard said it would be natural for consumers to feel a bit more apprehensive about the future of the country’s economy.

Having said that, he said Nielsen would be paying close attention to the next CCI as there have been multiple positive stories in the headlines ranging from better-than-forecast GDP growth of 4.5% along with the recent historical-high foreign direct investment inflow into Malaysia.

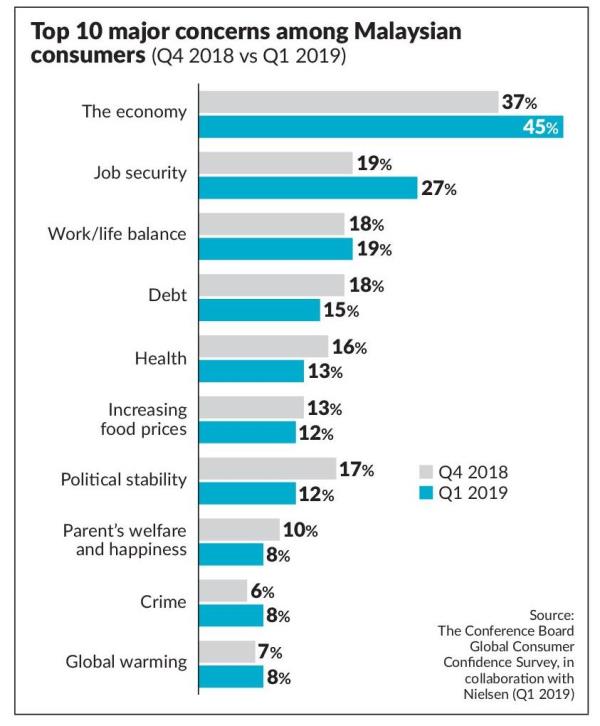

De Nard said the economy is the main concern among Malaysian consumers this year.

“The economy has consistently been a top concern for Malaysian consumers over the past few quarters and we don’t expect it to change this year.

“Even more so given Malaysia’s stable socio-political landscape. For example, there is very little risk of political instability or racial tensions.

“As such, three out of the top five concerns of Malaysians in first-quarter 2019 are bread and butter issues, namely the economy, job security and debt. The other two concerns – work life balance and health – are lifestyle concerns.

“The same goes for Singapore, where the top three concerns are the economy, job security and increasing food prices. Health and work-life balance round up the top five,” he said.

In Indonesia, however, De Nard said consumer concerns are more socio-political in nature – with more than half of consumers citing political stability as their bigger concern in first-quarter 2019. A distant second is the economy, followed by tolerance towards different religions, work-life balance and crime.

It is a similar scenario in Thailand where, in addition to concerns about the economy, consumers are also concerned about political stability (second place) and global warming (fifth place), he noted.

When taken in this context, he said the stability of Malaysia’s socio-political landscape meant that there is more focus placed on the economy and job security.

Based on the CCI, Malaysia posted the fourth highest year-on-year gain among 64 countries measured in the first quarter of 2019, up 11 points compared with the same period a year ago.

The CCI is driven by three indicators – consumers’ perception on local job prospects, personal finances, and intentions/readiness to spend. While perception on personal finances and job prospects are in line with the previous quarter, there was a significant drop in readiness/intent to spend.

For example, 71% of Malaysians believe the state of their personal finances in the next 12 months would be excellent or good (versus 70% in fourth-quarter 2018, 63% in first-quarter 2018).

It also showed that 70% have a positive view on job prospects in the next 12 months (versus 71% in fourth-quarter 2018 and 56% in first-quarter 2018) and 48% said now is the time to buy the things they want and need (versus 53% in fourth-quarter 2018 and 42% in first-quarter 2018).

De Nard said although consumers appeared largely positive about the country’s prospects in 2019, the confidence level may not always translate into spending, as a majority of consumers are conservative about spending at this point in time.

“As such, brands who are able to demonstrate value for money are more likely to appeal to the cautious consumers,” he noted.

He added that Malaysians are prudent spenders as indicated by the first-quarter CCI. Given consumers’ cautious optimism, he said, they are naturally more prudent when it came to spending. Indeed, close to nine in 10 Malaysians (88%) said they have adjusted their spending habits to save on household expenses.

“The bottom line is that Malaysians have always been financially prudent. “We know from our Shopper Trends study that a majority of consumers are price sensitive and nearly half actively seek out in-store promotions.

“Brands who want to win the consumer share of wallet would do well to keep these behaviours in mind,” De Nard said.

Source: TheStar