1 in 2 home loans are rejected in Malaysia

MALAYSIANS are finding it hard to own a house due to loan rejections. Here are 3 loan myths you need to bust if you want to get your loan approved instead.

MYTH #1 – If you’re ‘debt-free’ with no credit card, you’re more likely to be approved for a home loan.

Actually, not having a track record reduces your chance of getting a loan.

Without it, banks wouldn’t know how financially disciplined you are, and how likely you will repay your home loan. So, if you’re already thinking about buying a property, make sure to sign up for a credit card at least 6 months before you submit a loan application.

MYTH #2 – If you get rejected, you just have to keep trying to get a home loan.

Every time you get rejected, your chance of getting a loan is reduced. For example, if Bank A rejects your first loan application, it is less likely for Bank B and Bank C to approve your loan. This is because every loan rejection leaves a mark in your credit profile and the subsequent banks would not feel confident, knowing that you have been rejected before.

MYTH #3 – I know how much to budget for the property I want to buy, just by using any free loan calculators online.

Most online free calculators are inaccurate because they are made for the mass market. They are not personalised to your own financial situation, in particular, your credit score. Because of this, you end up getting inaccurate results which then causes you to get rejected by banks.

Now that you know why most home loans get rejected, you’re one step closer to owning your dream home.

Continue reading to find out how!

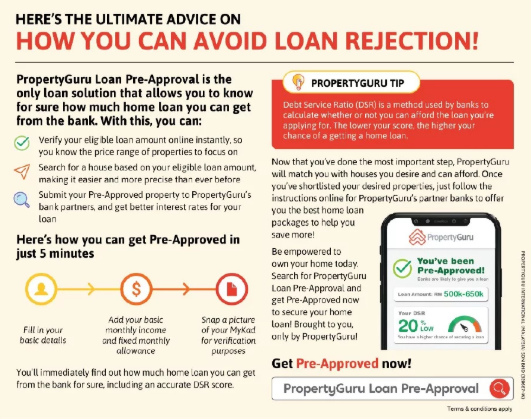

Here’s the ultimate advice on how you can avoid loan rejection!

PropertyGuru Loan Pre-Approval is the only loan solution that allows you to know for sure how much home loan you can get from the bank. With this, you can:

Verify your eligible loan amount online instantly, so you know the price range of properties to focus on.

Search for a house based on your eligible loan amount, making it easier and more precise than ever before.

Submit your Pre-Approved property to PropertyGuru’s bank partners, and get better interest rates for your loan.

Here’s how you can get Pre-Approved in just 5 minutes:

1. Fill in your basic details.

2. Add your basic monthly income and fixed monthly allowance.

3. Snap a picture of your MyKad for verification purposes.

You’ll immediately find out how much home loan you can get from the bank for sure, including an accurate DSR score.

PropertyGuru tip:

Debt Service Ratio (DSR) is a method used by banks to Calculate whether or not you can afford the loan you’re

applying for. The lower your score, the higher your chance of a getting a home loan.

Now that you’ve done the most important step, PropertyGuru Will match you with houses you desire and can afford. Once you’ve shortlisted your desired properties, just follow the instructions online for PropertyGuru’s partner banks to offer you the best home loan packages to help you save more!

Be empowered to own your home today.

Search for PropertyGuru Loan Pre-Approval and get Pre-Approved now to secure your home loan!

Brought to you, only by PropertyGuru!

Source: NST