Maybank not keen on digital licence

KUALA LUMPUR: MALAYAN BANKING BHD (Maybank), which reported a net profit of RM8.2bil for the financial year ended Dec 31,2019 (FY19), is not keen on applying for a digital banking licence as its current licence both here and in Singapore already allows it to carry out such operations, its chief said.

“From that perspective, when we consider whether we should apply, we ask ourselves, why should we?” group president and chief executive officer Datuk Abdul Farid Alias said.

“I think the licence is meant more for institutions and entities that are not in the banking sector today, ” he said during a briefing on the company’s FY19 results here yesterday.

Farid said Maybank has been on a digital journey since 2014.

“We don’t (talk) about it much because we like to do first then talk, rather than talk and then try to prove we can do it.”

Bank Negara is set to issue up to five licences to qualified applicants to establish digital banks here while Singapore’s Monetary Authority of Singapore has already received more than 20 applications for up to five licences of such type, in the city-state.

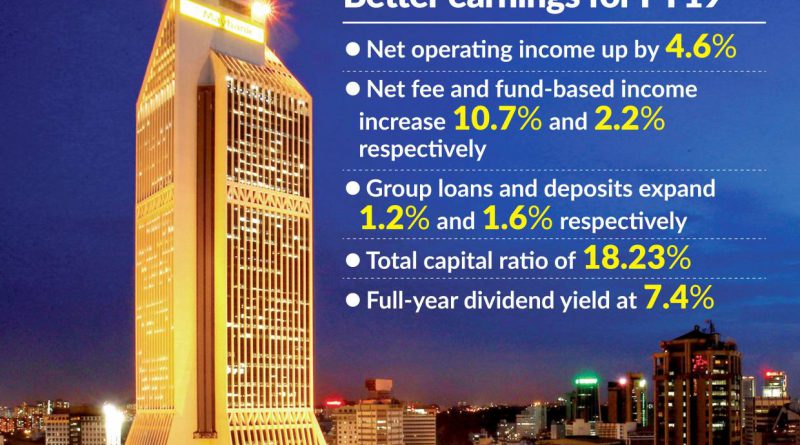

Maybank, the fourth largest lender in Southeast Asia, yesterday said it made a net profit of RM2.45bil for its fourth quarter ended Dec 31,2019,5.15% higher than a net profit of RM2.33bil for the same period, a year earlier.

Net profit for FY19 stood at RM8.2bil – a new high – from RM8.11bil in 2018, boosted by banking and insurance and takaful segments, as well as a particularly strong fourth quarter, the bank said.

Revenue for the year was at RM52.84bil against RM47.32bil a year earlier.

Farid said Maybank will continue to be selective in balance sheet expansion, in line with the group’s risk appetite and amid economic uncertainties and issues like the Covid-19 outbreak.

The bank has guided for a group return on equity (ROE) of 10% to 11% for FY2020, taking into consideration slower economic growth and a lower interest rate environment.

Chief financial officer Datuk Amirul Feisal Wan Zahir said Maybank was also expecting a net interest margin (NIM) compression of 5 basis points in FY2020 as a result of such issues.

In FY19, the lender reported a ROE of 10.9% while NIM fell by six basis points to 2.27%.

On how big an exposure the bank’s current loan portfolio is to customers that are considered vulnerable to the current Covid-19 outbreak, Amirul said “quite small”.

Farid said the bank had completed a stress test on the impact of the virus outbreak, taking into consideration its exposure to the sectors directly impacted by it.

“We have more than sufficient buffers in terms of liquidity and capital, ” he said.

“I can’t tell you the exact potential impact on earnings but our exposure (to affected sectors like airline and tourism) is a lot less than 10%, ” he said.

“I’m hoping it will be a V-shaped recovery and that we can contain it early.”

In FY19, the group’s gross loans expanded by 1.2%, contributed by a growth in Malaysian operations where it outpaced the industry with a 4.9% expansion, according to Maybank’s statement.

The home markets of Singapore and Indonesia however saw a decline by 3.9% and 8.2% respectively, mainly as a result of write-offs and repayments as the group continued to manage its exposure in these markets, it added.

Maybank did not provide any loan growth projections for FY2020 as has been the case in recent times.

As at December 2019, the bank’s gross impaired loan ratio stood at 2.65% from 2.41% in December 2018.

The lender has proposed a final single-tier cash dividend of 39 sen per share, which together with the interim dividend of 25 sen per share, takes the full-year all-cash dividend to 64 sen per share or a 7.4% yield.

At market close yesterday, Maybank’s stock ended 19 sen higher to RM8.52, valuing the banking group at some RM95.8bil.

Source: TheStar