Auto sector shifting gears

PETALING JAYA: As the world grapples with the Covid-19 crisis, many automotive firms across the globe have shut down their operations in tandem with the nationwide lockdown of their respective countries.

On the local front, many car companies have announced that they are temporarily suspending their operations in light of the government’s movement control order from March 18 to March 31.

“This will certainly have an impact on total industry volume (TIV) should the situation drag out longer than expected, ” said an industry observer.

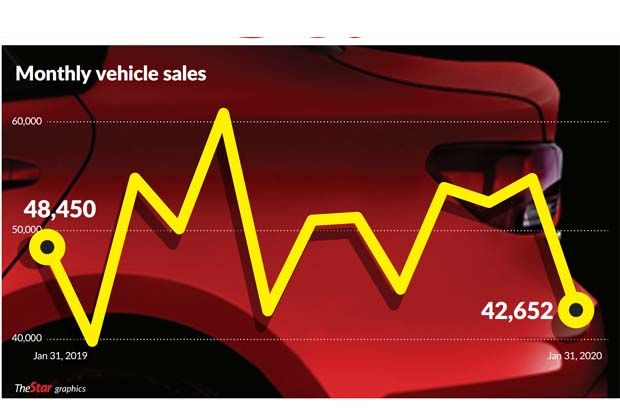

Malaysian TIV got off to a weak start this year, with vehicle sales contracting 12% year-on-year in January to 42,652 units.

An analyst said vehicle sales for February was expected to be flat, if not slightly better than January’s as the government’s movement control order only kicked in this month.

“We expect sales for March to be severely affected due to the movement control order.

“We don’t think year-on-year sales for April will be in positive territory either, if the Covid-19 crisis is not abated.”

Earlier this week, national carmaker Proton Holdings Bhd said production activities at its Tanjung Malim and Shah Alam plants will cease in unison as it systematically shuts down all its operations in an effort to help with the control of the spread of the Covid-19 pandemic.

Therefore starting March 18, all customer-facing activities such as sales and after sales will cease as all Proton outlets will be temporarily shut.

Similarly, Perodua said it suspending all operations at its head office, manufacturing facilities, sales and service centres, as well as body and paint outlets nationwide until the end of the month.

“Due to this, new vehicle deliveries, servicing and body and paint services are expected to resume only after the movement control order is lifted, ” the company said in a statement.

UMW Toyota Malaysia, on its website, said all its authorised Toyota and Lexus dealers will temporarily cease its usual day-to-day operations but remain contactable to all customers.

Honda Malaysia also said it is temporarily suspending its business operations, namely the company’s plant in Pegoh, Melaka, sales office and dealerships nationwide.

“We will resume business operations tentatively on April 1.”

The growing Covid-19 pandemic saw China’s vehicle sales practically getting crushed last month, plummeting a record 80% as potential customers stayed away from showrooms nationwide.

China, the largest automobile market globally in terms of both demand and supply, recorded its biggest monthly plunge on record last month as the Covid-19 pandemic kept shoppers away, Bloomberg reported earlier this month.

It says the outbreak is already intensifying the pressure on automakers that are battling an unprecedented slump before the outbreak.

“The outbreak has paralysed the industry just as it was looking to gradually halt a two-year decline, with manufacturers now left with little visibility into when sales might recover.

Automakers have poured billions of dollars into the world’s largest car market over the past decades in a bet on its growth potential, ” it reported.

Citing the China Passenger Car Association (PCA), Bloomberg reported that everyone, from market leader Volkswagen AG and electric-car maker Tesla Inc to smaller local contenders have been pummelled as the spreading Covid-19 outbreak hit both demand and production.

“Wholesales from carmakers to dealerships probably plunged 86% in February.

“Millions of companies in China are in peril as consumers stay home and output at factories remains disrupted.

“Activity in the country’s manufacturing sector contracted sharply in February, with the official gauge plunging to the lowest level on record.”

Fighting backAccording to an article on the World Economic Forum (WEF) last month entitled “This industry was crippled by the coronavirus – here’s how it’s fighting back, ” many auto companies in China closed their doors as part of the recent nationwide shutdown.

“The impact on the auto industry are being felt beyond China’s borders, as shortages of supplies from China stall production around the world.”

In response to the virus, the WEF report said many auto companies are looking for solutions to get back to work.

“For example, with customer traffic in traditional dealerships heavily reduced, some carmakers turned to digital solutions.

“Besides new automotive players like NIO, XPeng, who were born with online-to-offline genes, many traditional automotive brands, including Volkswagen, Nissan, SAIC and BMW, turned to online shopping for cars using tools including virtual reality and live broadcasts to stimulate sales, ” said the report.

In response to a severe shortage of facial masks, the report said SAIC-GM-Wuling Automobile (SGMW) had announced it would produce masks, which can help prevent the virus infection via respiration.

“SGMW worked with Guangxi Defu Technology, who is an interior parts supplier, to install mask production in Guangxi Province. There will be 14 new production lines for both medical masks and N95 facial masks with the planned volume of 1.7 million per day.

The first batch of 200 thousand masks from SGMW were finished on Feb 9.

The report adds that automakers BYD Co and GAC Motor Co also announced it would produce masks and disinfectants at their factories.

“The planned capacity of BYD production is five million masks and 50 thousand bottles of disinfectant per day, with the first batch donated to drivers of public buses, taxis, ride-hailing fleets and volunteers fighting the outbreak.”

It added that as businesses resume operations, there may be a surge in growth in the automotive market, noting however that it will take time to go back to “normal levels.”

“Still, the outbreak will surely accelerate industry consolidation and transformation, ” it said.

On the local front, total vehicle sales finally exceeded 600,000 units in 2019 after failing to surpass that mark for three consecutive years, rising 1% year-on-year to hit 604,287 units.

The Malaysian Automotive Association is projecting a TIV growth of less than 1% to 607,000 units for this year.

Source: TheStar