Tenants and owners keen to purchase a home with lower interest rates

A survey by property rental platform, Speedhome shows that up to 80 per cent of the respondents, comprising tenants and owners are willing to purchase a house within the next three years or so, should loan interest rates and house prices fall at the same time.

Up to 67.8 per cent of the respondents said they would consider buying a house within three years, while 12 per cent said they would consider buying if house prices continue to fall.

“In other words, as many as 80 per cent of the survey respondents are willing to buy houses,” said Speedhome chief executive officer Wong Whei Meng.

“There is an oversupply of property (and) some interviewees believe that property prices are falling. If their income is not affected, they are willing to buy a house,” he said.

Wong said as many as 54.7 per cent of the respondents believe that Malaysian property prices will appreciate again in the next few years.

This shows that their confidence in residential property has not been affected by the temporary decline in prices, he said.

“They still believe that property is a good investment.”

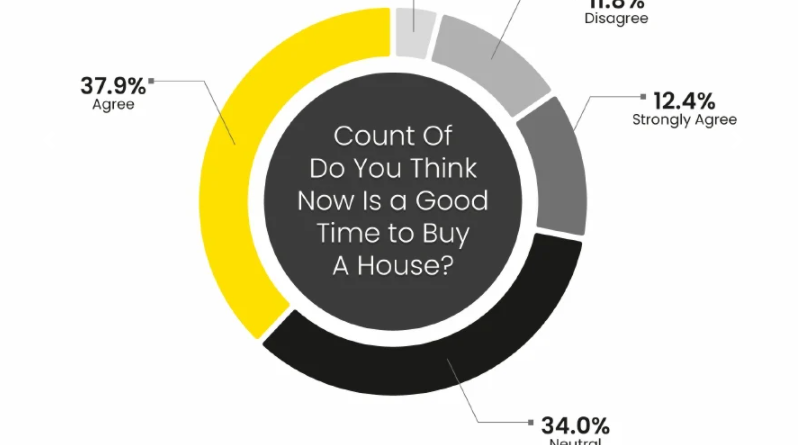

The survey showed that young people between the ages of 20 and 40 have confidence in the property market and up to 40 per cent of the respondents think it is a good time to buy a house. At least 75 per cent are Malaysians under the age of 40.

“Although the pandemic has hit the economy and the unemployment rate in Malaysia is at a record high, young people still think it is a good time to buy a house,” Wong said.

He said interest rate is a critical factor for them to consider when buying a house.

In terms of house prices, the range of RM200,000 to RM300,000 has become an indicator of affordable housing for Malaysians.

Wong said the budget for most young people to buy a house is between RM200,000 and RM300,000, accounting for more than 72 per cent of them.

“Only 4.9 per cent of the respondents refer to affordable housing price as higher than RM500,000, which shows that houses above RM500,000 are not favoured by people under 40,” he said.

The survey also showed that at least 51.1 of the respondents are willing to spend up to 40 per cent of their salary to rent or buy a house, and 34.5 per cent are ready to pay 10 per cent to 20 per cent for the house.

“This shows a percentage of younger generation’s spending habits when it comes to renting or buying a home,” said Wong.

On property overhang, Wong said that some interviewees pointed out that the government should strictly approve new development projects and control supply.

Some felt that restarting Developer Interest Bearing Scheme will help stimulate the housing market.

“Speedhome believes that Malaysians are still enthusiastic about property investment. As long as the house price does not exceed RM300,000, they still can find potential buyers. Most Malaysians agree that the current market housing prices are beginning to fall, and bank loan interest rates have also hit a record low, which to a certain extent has stimulated the willingness of Malaysians to buy houses,” Wong said.

Source: NST