Opportunities in property market

Homebuyers aged between 22 and 29 years old see opportunities in the current favourable environment, spurred by historically low-interest rates, incentives from the extended Home Ownership Campaign (HOC), as well as attractive prices and packages offered by developers.

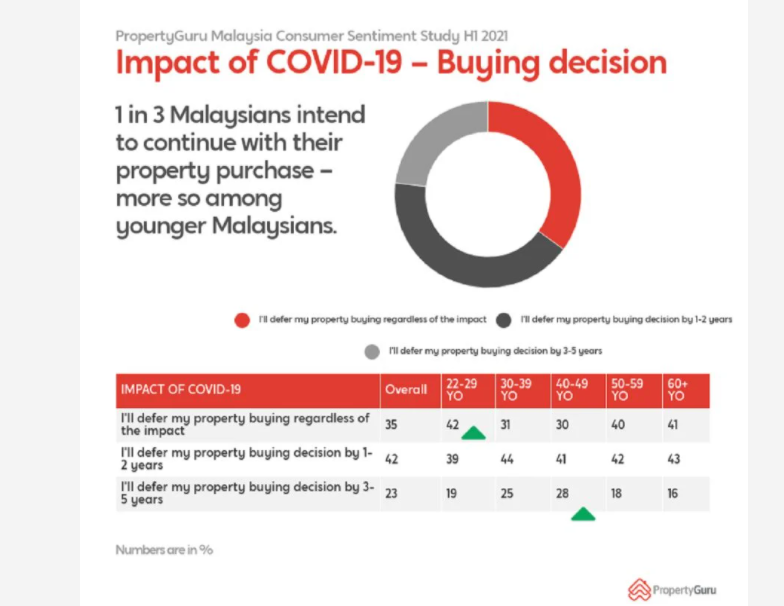

Based on the recently concluded Consumer Sentiment Study H1 2021 by PropertyGuru Malaysia, over 35 per cent of the respondents expressed their interest to own a property.

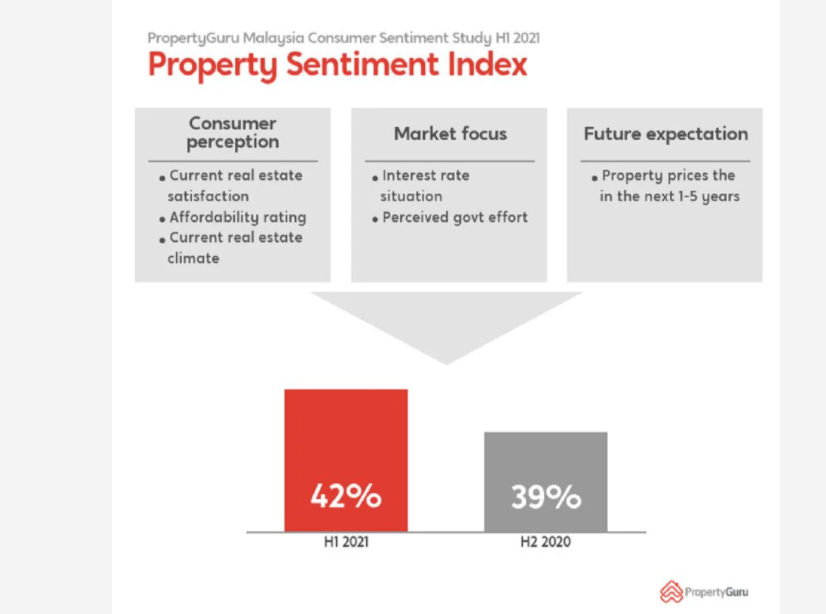

“Although with a slight uptick in sentiment, Malaysians are still realistic but cautious about property purchase, with 42 per cent adopting a wait-and-see approach in anticipation for a better deal in the future,” said PropertyGuru Malaysia country manager Sheldon Fernandez.

Fernandez said that many are expecting house prices to drop further as developers have adjusted their pricing strategy to launch more affordable homes.

Over 50 per cent of the new launches in Q3 2020 were priced below RM300,000.

“With more affordably-priced properties available in the market, property owners who are desperate to let go of properties have no choice but to reduce the asking price, thus price trends of properties in the secondary market will be fairly linear,” he said.

Some 52 per cent of the respondents said the difficulties in forking out the down payment for the property purchase remains the main barrier that stops them from applying for a home loan.

The survey showed that job instability (46 per cent), unfamiliarity with paperwork (33 per cent), poor credit history (27 per cent) and lack of supporting documents (25 per cent) are the top five barriers in taking a home loan.

Pandemic has jeopardised property buying decision

Property buying decisions (in the last few months) was jeopardised by the Covid-19 pandemic which had impacted the financial strength and job security of Malaysians.

“With prospects of a mass vaccination program slated to be rolled out early this year, it could be an antidote to the uncertainties that we currently face as Malaysians brave through the third wave of infections. Nevertheless, a sense of acceptance of the new normal and the incentives that are currently in place have reflected a slightly improved sentiment,” Fernandez said.

Fernandez said that despite the short-term pain during times of uncertainties, it is believed that after the mass vaccination program is underway, Malaysia’s economy will be on the mend with forecasted improvements within the property sector in H2 2021.

“The property market is poised for a gradual recovery in 2021, driven by a better economic outlook and historically low-interest-rate environment.

“This is reflected by Bank Negara Malaysia’s (BNM) latest decision to maintain the overnight policy rate (OPR) at 1.75 per cent, as the central bank sees continued recovery in the global economy. However, downside risks remain, amid uncertainties surrounding the Covid-19 pandemic,” Fernandez said.

The property market will also likely be seeing increased sales in the first half of 2021 as the HOC ends on May 31, 2021, he added.

Source: NST