PropertyGuru: Purchasers Adopt Wait And See Approach In Buying Property

The sharp surge of COVID-19 cases has caused the country’s healthcare system to be at a breaking point. This has led the Government to announce a movement control order (MCO) nationwide until February 18, 2021.

‘With prospects of a mass vaccination program slated to be rolled out early this year, it could be an antidote to the uncertainties that we currently face as Malaysians brave through the third wave of infections.

“Nevertheless, a sense of acceptance of the new normal and the incentives that are currently in place have reflected a slightly improved sentiment in our recent Consumer Sentiment Study H1 2021 findings,” said Sheldon Fernandez, Country Manager, PropertyGuru Malaysia.

PropertyGuru, the country’s No. 1 Property Website has revealed an increase within its property sentiment index, from 39 points (H2 2020) to 42 points (H1 2021). Contributing factors include: current real estate satisfaction, positive outlook on property climate, favorable interest rate environment, positive government efforts and favourable price outlook.

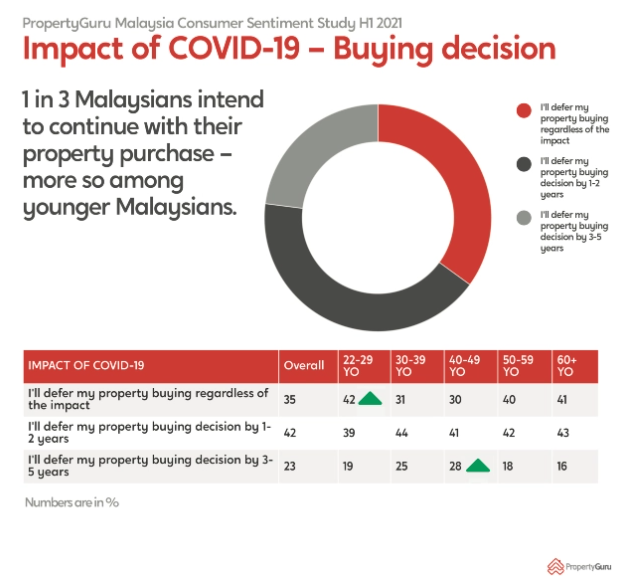

Although with a slight uptick in sentiment, Malaysians are still realistic but cautious about property purchase, with 42% adopting a wait-and-see approach in anticipation for a better deal in the future.

“Many are expecting that housing prices will go down further as developers have adjusted their pricing strategy to launch more affordable homes. According to Kenanga Research, over 50% of the new launches in Q3 2020 were priced below RM300,000.

With more affordably-priced properties available in the market, property owners who are desperate to let go of properties have no choice but to reduce the asking price, thus price trends of properties in the secondary market will be fairly linear,” added Sheldon.

On the other hand, a total of 35% of the respondents (mostly aged between 22 – 29 years old) have expressed interest in owning a property as they see opportunities in the current favourable environment, and spurred by historically low-interest rates, incentives from the extended Home Ownership Campaign (HOC), as well as attractive prices and packages offered by developers.

Homeownership Challenges

The COVID-19 pandemic has also jeopardised the financial strength and job security of Malaysians, which in turn affects property buying decisions.

Entrepreneur and Cooperative Development Minister Datuk Seri Wan Junaidi Tuanku Jaafar revealed that over 30,000 businesses have shut down last year since the start of the pandemic.

99,696 workers were also laid off between January and November 27, 2020, due to the spread of COVID-19. For those who are able to keep their jobs, many are seeing salary cuts due to the challenging market environment.

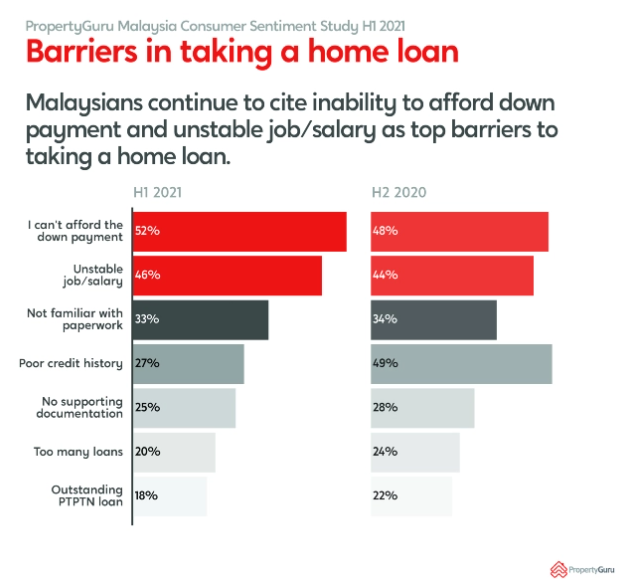

52% of the respondents said the difficulties in forking out the down payment for the property purchase remains the main barrier that stops them from applying for a home loan.

Meanwhile, job instability (46%), unfamiliarity with paperwork (33%), poor credit history (27%) and lack of supporting documents (25%) are the top five barriers in taking a home loan.

2021 Market Outlook

In reviving the country’s economy, the Malaysian government had allocated the largest national budget at RM322.5 billion to spur economic growth. Over 500,000 new jobs for Malaysians is also expected to be created within the next two years.

Despite the short-term pain during times of uncertainties, it is believed that after the mass vaccination program is underway, Malaysia’s economy will be on the mend with forecasted improvements within the property sector in H2 2021.

“The property market is poised for a gradual recovery in 2021, driven by a better economic outlook and historically low-interest-rate environment.

“This is reflected by Bank Negara Malaysia’s (BNM) latest decision to maintain the overnight policy rate (OPR) at 1.75%, as the central bank sees continued recovery in the global economy.

However, downside risks remain amid uncertainties surrounding the COVID-19 pandemic.

“The property market will also likely be seeing increased sales in the first half of 2021 as the Home Ownership Campaign (HOC) ends on May 31, 2021,” added Sheldon.

Source: PropertyGuru