Sabah – A shifting tide in 2021

The Land Below the Wind as it is often referred to, Sabah is a land of abundance. From the pristine shorelines to the mountainous peaks and her epic natural wonder of flora, fauna, and mystical rainforests, 2020 would have been yet another successful year had it not been for the Covid-19 pandemic.

As part of the country’s strong tourism ammunition and the state’s third-largest contributor that has the propensity to lure tourists from as far as Europe and the Americas, not forgetting its staple tourists from China, Sabah missed turning it into another golden year after registering positive tourism growth annually from about four years ago starting 2016. To be halted in its steps due to the Coronavirus is definitely a big blow to its grand plans but as the old adage goes, when one door closes, another opens, the steady rise of the crude palm oil prices from May (RM2,074/tonne) to December 2020 (RM3,621/tonne) had come in at the right time to save the day. All hopes are therefore not lost but a winded economy that had gone on a repeated cycle of start-stop throughout the year including the Sabah State Elections on 26 September 2020 that was blamed for the current third wave of the Covid-19 in the country had nevertheless left her citizens breathless, and worse some industry players permanently resigned asthey buckled under the incremental pressures of minimal to zero business.

In the property sector, Sabah has had a muted year in 2020 as a consequence of the pandemic which also barred visitors from West Malaysia from entering. Coupled with the restricted movements and it entered into a period where the masses can no longer find easy opportunities other than seeing prime products of landed residential, industrial, commercial and residential development lands, which are usually scarce in Kota Kinabalu, taken up at sustained prices by local followers and buyers for their own use, different from the speculative days like before.

For properties in the secondary locations, retail shops in the shopping complexes, and high-rise residences, price corrections had also been spotted from Q3 2020. The ensuing twelve months as such will be critical for these categories because of the impact a potentially free fall of the already depressed prices will bring to the market. But regardless of the outcome, it is foreseeable that property developers will continue to market their products and justify the accompanying sale prices by citing increasing cost-push factors. In that regard, the market may also start to see smaller units making their way into the market girded with competitive pricing to maximise take-up rates and depart totally from the speculative prices more prevalent between 2011 to 2015.

As the market moves into a buyers’ market era in 2021, the onus shall be on the developers and all property stakeholders to sweeten the deals for the buyers as they now hold the trump card to finalising transactions at any time convenient to them, and let’s not forget the incentives provided through the Home Ownership Campaign 2020-2021 as well. Should the gestation period play out a little longer, property developers could also utilise this time to reflect upon their strategies and plan into the future before they execute every actionable item on the blueprint.

Residential – review 2020

Admittedly, and like the rest of the country, the most glaring period for the residential sub-sector in Sabah was when MCO was imposed in March. The nationwide lockdown has decreased take-up rates of residential properties to only 561 transactions in Q2 2020 before it quickly recovered back to 1,525 transactions in Q3 2020, registering a 171 per cent growth and exceeding the 1,361 transactions recorded in Q3 2019. There is however insufficient evidence to conclude which portion of this steep rise is attributed to the previous quarter’s transactions that weren’t recorded in the registry due to MCO and which were actual third-quarter transactions. Nevertheless, movement on the ground suggested that the take-up rate had indeed gradually increased after the lockdown was loosened.

Projects which were launched in 2019 and continued to be marketed or constructed in 2020 were faced with the pandemic setback as well as the stuttering start and stop-work orders by the government to curb the spread of Covid-19, which made it more difficult to be productive. This has also deterred willing buyers from committing to the purchase as they would’ve changed their minds after the flip-flop policies.

With Covid-19 still a threat to most in 2020, project launches were not as robust and although some developers rolled out new releases to the market, they were of a smaller scale compared to previous years with most featuring smaller condominium units owing to the higher land cost in the city of Kota Kinabalu. From these launches, the take-up rate had been relatively slow as they had to also compete with existing projects in the markets with some projects launched as far back as four years ago. Seeing that these projects still have unsold units to clear, it is an indication of the level of difficulty developers will face in securing buyers had they also put up new properties to the market in 2020.

Residential outlook 2021

With a downright challenging time to find buyers, the market also found it tricky to lock in tenants for rental. Factors such as these have not been conducive for investors because unlike before, they can no longer flip properties for a quick profit, and to make matters worse, any new high rise property, especially condominiums, in the market is expected to take up to three years for it to be fully taken up by interested buyers.

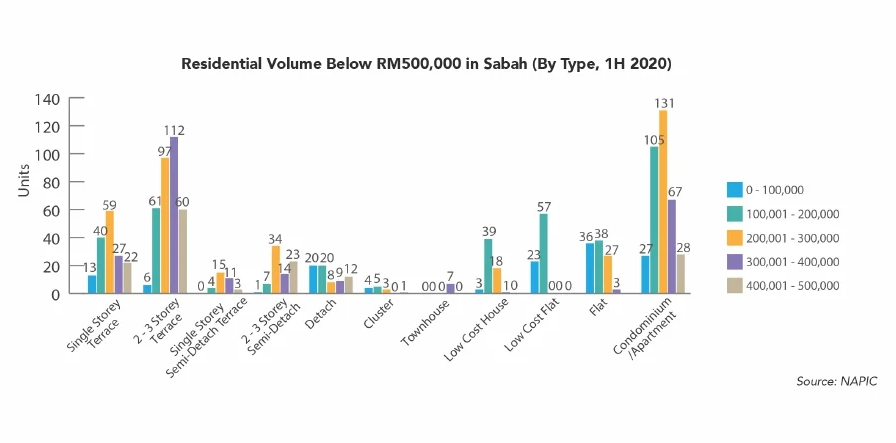

Market movements aside, developers are however accustomed to dishing out the right marketing techniques to justifying their value proposition in any season. So if buyers were doubtful of the typically high prices or depressed sentiments, developers were ready to defend citing valid reasons to the pricing model and the relevant cost-push factors such as the land acquisition cost to arrive at the final pricing. But not undaunted by the challenging market, some developers have also taken the opportunity to remodel their products to be more competitive. For example, instead of launching larger units, the market has compelled developers to incline towards the smaller sizes for better pricing brackets to facilitate better take-up rates. These are also sometimes backed by the strategic location of the development and the kind of facilities it is equipped with as part of the development’s unique selling proposition. It goes without saying that when looked at from a developer’s perspective, 2021 stands out as a year more ideal for planning than for executing. It is a year cut out for mapping the right strategies with the right products at the right prices. One can therefore expect Sabah’s residential market to be slow in the next one to two years or until the economy recovers with confidence returning. Meantime, transactions shall be more price-sensitive as buyers narrow their search at the affordable range priced below RM500,000 for both landed and high-rise residential while properties under construction continue to add to the supply pool. In the secondary market, the demand shall continue to exist as long as prices are reasonable with landed properties in prime location remaining as the most sought after given its potential upside value.

Factors to watch in 2021

● Re-opening of the borders and the return of international tourists bode well for Sabah.

● Pan-Borneo Highway is the single most important impetus for 2021 and also for the next 5 years.

● Continuous growth from the palm oil industry will see palm oil players reinvesting the profits into the property sector and also motivate downstream palm oil-related manufacturing activities to commence in Sabah spurring a series of economic multiplier effects.

● Prices of properties in secondary locations, retail shops in the malls, and highrise residences may sway the market if it plunges further than expected.

● Property developers taking advantage of the slow market to re-strategise and develop new products and pricing to better suit the existing market.

● Sabah’s pursuit of its rights for greater oil and gas revenue from Petronas.

Bright spots for 2021

● Prime properties in Kota Kinabalu such as landed residential, industrial, commercial and residential development lands may offer opportunities if the economy continues to be under pressure.

● Prime industrial properties have remained well in demand with cash-rich and high-income investors/industrial owners continue to buy. General hotspots include Kolombong/Inanam area, Lok Kawi Industrial Centre, Jalan Tuaran By-Pass area, KKIP area (near Sepanggar Container Hub).

Commercial & office overview

Over in the commercial space, purpose-built offices (PBO) in Kota Kinabalu have always been pitted against the conventional shop offices, primarily due to the historically static and lower prices or rents from the upper floors of conventional shop offices. As such, owners of PBOs are pressured to withhold increases in asking prices and maintain rental rates to remain in the competition.

Occupancy on the other hand has also dropped as businesses continue to struggle but it is worthy to note that the exodus from the office in Sabah is not entirely because of the work from home (WFH) initiative seen elsewhere. In fact, businesses in Sabah are unlikely to adopt the WFH culture, preferring instead the traditional way of separating work and home as two distinct activities, housed in two separate properties. But the Covid-19 fright has certainly been a nightmare for businesses in the tourism industry as most have been forced to grind to a halt in the last ten months and many are still closed with a significant number discontinuing office tenancies. Only some of the sustaining ones are waiting to see how the situation develops in 2021.

Occupancy in prime districts has reportedly dropped by almost 30 per cent to 40 per cent too. Taking the prime Jalan Gaya as an example, the vacancy rate was nil or almost nil pre-pandemic, packed with F&B outlets and shops catering to the visiting tourists but ever since the border closures and various forms of MCOs have been imposed, occupancy has dwindled to only 50 per cent to 60 per cent with rental dipping by 50 per cent. In this sense, landlords were equally compromised and have no choice but to reduce rental by about 30 per cent to 50 per cent for the sake of retaining tenants.

Commercial & office outlook 2021

As the industry is not expecting to see a sudden influx of high-end large corporate office users, prices and rental rates are therefore not anticipated to increase significantly. The erosion of any potential appreciation is dragged down further by externalities such as the continuous competition from conventional shopoffices, evolving business models, ease of connectivity via the Internet, and the incoming supply of commercial SoHo and SoVo units launched prior to Covid-19. The need for PBOs as such is gradually being eliminated as smaller companies and individual business owners possess the flexibility to operate in cheaper and smaller spaces to reduce cost.

The lack of real demand, lower sale price per sqm (compared to high-end and higher density residential estates) and a slow market have become the factors that discouraged developers from venturing into large-scale office developments in recent years. Suffice to say, things have not been too rosy for the office sub-sector and as such it is predicted to perform moderately or muted in the coming few years.

Hospitality overview & outlook 2021

Looking back, Sabah has traditionally been a strong market for tourism, so much so the Kota Kinabalu International Airport is the second largest airport in Malaysia. The fact that an air transportation terminal that big is invested in Sabah shows that it has the volume of arrivals to cater to as visitors fly in from around the world, and just from January to September 2019 before the pandemic, Sabah welcomed a total of 3.112 million tourists. Such promising numbers have unfortunately dropped by about 69.5 per cent, with only 948,651 tourists walking through immigration from January to September 2020. The drastic decline has impaled businesses in the tourism sector such as the travel agencies, hotels, shopping malls, recreation providers, attractions, just to name a few, leaving them with little choice but to exercise retrenchment, relocation, and securing loans among others to survive. Some have also attempted to sell off their businesses or shut down for good.

With the insignificant number of travellers in Sabah in 2020, hotel occupancy has submerged to between 10 per cent and 25 per cent. As survival has then been called into question, hotels began lowering rates as part of the solution to continue the business. But the detrimental situation has caused catastrophic spillover effects throughout the industry with retail tenants also moving out of shopping malls, travel agencies forced to venture into different businesses (eg. supermarket, food), and all other related enterprises hanging by a thread. To date, the tourism sector has definitely been the worst hit among all sectors in Sabah with no avenue for recovery so long as the borders remain closed and a safe vaccine against Covid-19 continues to be out of reach.

Industrial review & outlook 2021

Large logistics companies in Sabah may have seen a general increase in business but this has yet to be translated into new properties being taken up or at least not yet. Thus far, logistics companies in Sabah are still considered small-scale players with no integrated hub or centre commissioned by any of the major logistic players. But despite the lack of a large-scale logistics operator, the industrial market is expected to see a recovery and growth in 2021. This comes on the back of a rather unscathed experience in the sub-sector compared to tourism. The only foreseeable major stumbling block is the reduced demand as exporting activities to major international markets have been halted and local consumption for manufactured products and services has also reduced due to the economic downturn. The substantial decrease in revenue and high cost of larger industries have inevitably forced owners who are unable to cope to reduce operation costs and downsize their workforce. On the bright side, a majority of the manufacturing, warehousing, and service sectors in the essential services category are still provided with the opportunity to continue operating but most have been pressured to keep their operations afloat and are only looking at sustaining so that they will be at the right place and the right time to stage a quick recovery once the pandemic is over. Notwithstanding the pandemic, prime industrial properties in Sabah have remained well in demand with cash-rich and high-income investors as well as industrial owners continuing to purchase prime and well sought after industrial locations especially in the Kolombong/Inanam area, Lok Kawi Industrial Centre, and Jalan Tuaran By-Pass area. Factory owners/operators have also continued to seek and purchase lands and warehouses within the KKIP area which are near to the Sepanggar Container Hub. These are positive indicators that there remains strong demand for industrial properties from purchasers and industrial owners looking to expand business operations and increase their property investment portfolio for long-term capital gains.

A recovering and possibly thriving industrial sub-sector is on the cards in 2021 for Sabah but this hope hinges on the state’s and also the federal government’s ability to contain the Covid-19 pandemic. – Henry Butcher Malaysia

Source: NST