Pemulih for Malaysians from all walks of life

KUALA LUMPUR: Pakej Perlindungan Rakyat dan Pemulihan Ekonomi (Pemulih) is an all-encompassing scheme benefiting Malaysians from all walks of life, not just the B40 category.

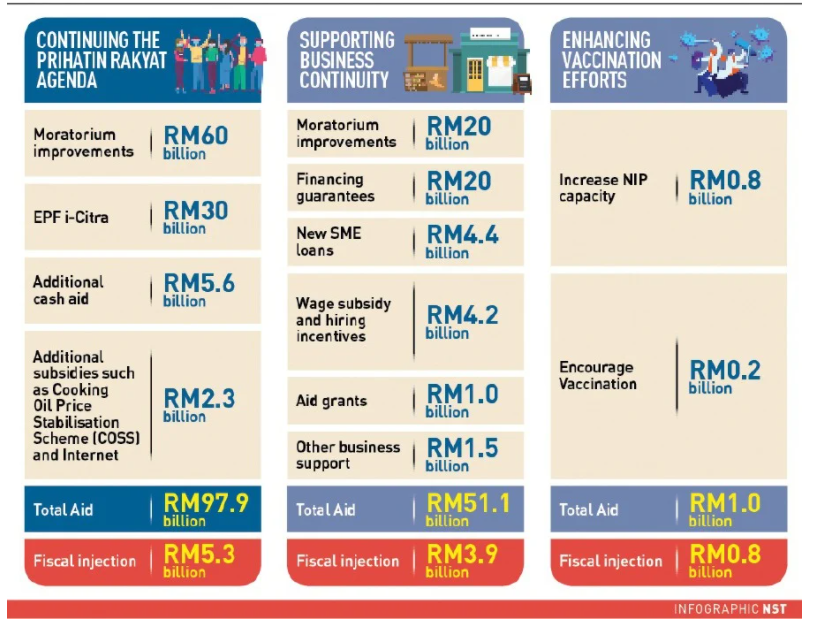

The automatic loan moratorium and new Employees Provident Fund withdrawal scheme are the major initiatives that could be used by the M40 and T20 groups too, said National Budget Office director Datuk Johan Mahmood Merican.

The two initiatives were introduced by the Perikatan Nasional government under the RM150 billion Pemulih stimulus package.

Johan said the B40, or the low-income segment, was the most affected group during the Covid-19 pandemic. “It is not true, however, that there are no benefits for the M40 and T20 groups.

For example, the moratorium previously targeted the B40 group while the M40 and T20 groups would only get it based on certain conditions. “But now, under the Pemulih package, the moratorium will be given automatically to all groups,” he said.

Johan said i-Citra was expected to benefit six million EPF members, adding that most of them were in the M40 group as they have additional savings that can be withdrawn under the programme.

He said Prime Minister Tan Sri Muhyiddin Yassin had stressed that all aid programmes and initiatives, especially under Pemulih, should be implemented immediately. “Last week, additional assistance under the Bantuan Prihatin Rakyat (BPR) with over RM2 billion was channelled to over eight million recipients,” he said.

Additional payments of RM1,000 will be paid this month under the Prihatin Special Grant that will benefit over one million eligible micro-small medium enterprises.

Those eligible will also receive the first payment of RM500 in July, September and November.

He said there were also other programmes to be implemented this month that would benefit taxi drivers, as well as the telecommunication subsidy of RM150 each for the B40 group and e-Belia from the government.

Johan said Pemulih entailed initiatives based on each of the National Recovery Phase requirement.

“For example, the wage subsidy programme initially will apply for two months in all sectors in line with the National Recovery Plan’s Phase One and Two as most sectors were closed.

“Transitioning into Phase Three, there will be an additional two-month wage subsidy programme, focusing on affected sectors that are unable to operate,” he said.

Johan said the government had allocated over RM1 billion under the National Entrepreneurial Group Economic Fund (Tekun) through AgroBank and Bank Simpanan Nasional to help businesses to resume operations.

There was also an additional fund from Bank Negara worth RM8.6 billion fund for SMEs as well as RM20 billion of government guarantees for SME financing.

Johan said the government was concerned about those who had lost their jobs and hence, had introduced the wage subsidy programme.

“It is one of the initiatives that cost a big sum to the government. Over RM15 billion has been dibursed under the wage subsidy programme.”

He said RM3.8 billion was given to selected companies under Pemulih to help them retain more than 2.5 million jobs.

“The government has also improved Insentif Pengajian under the Penjana Kerjaya Programme for those who want to find jobs.

“We have made the conditions more lenient to attract more employers to employ locals. There is also allowance for job seekers under Socso as previously it was only given to contributors.

“But now it has been opened to all, especially non-members and young graduates or informal sectors, to allow them to find jobs with many opportunities, including websites such as MyFutureJobs,” he added.

Source: NST